C Corp, S Corp, LLC? Finding the Best Fit for Your New Business

Figuring out what type of business entity matches your new company’s needs is challenging. Choose wrong, and you could find yourself unable to grow your company the way you want to. Toptal finance expert Scott Hoover, a seasoned CPA and interim CFO, shows how to make the right decision.

Figuring out what type of business entity matches your new company’s needs is challenging. Choose wrong, and you could find yourself unable to grow your company the way you want to. Toptal finance expert Scott Hoover, a seasoned CPA and interim CFO, shows how to make the right decision.

Scott is a seasoned CPA and interim CFO who has helped clients achieve financial clarity in a wide range of industries. He specializes in high-level monthly financial oversight, accounting software projects, and corporate tax planning.

Previous Role

Interim CFOPREVIOUSLY AT

You’re about to start a business in the US. You have a great idea and a winning team. You’ve thought through your business plan. You’re ready to make it official—but before you can begin, you have to decide what kind of business entity makes the most sense for your new company.

There are several types of business entities and the one you choose determines how your business is regulated and taxed. Your choice of entity fundamentally boils down to a few key considerations:

- How profits are taxed

- The complexity and cost of setting up the business, as well as ongoing governance and administration

- Liability protection, particularly of an owner’s personal assets

While in some cases the choice can be obvious, it isn’t always. Each entity type offers a unique blend of legal and tax implications, and figuring out what’s right for a specific business can be complicated.

With more than 20 years of experience in accounting—including more than 14 years of providing CFO services to companies across multiple industries—I have advised numerous C corporations, S corporations, LLCs, and partnerships on tax and entity-choice matters. In this article, I’ll present the crucial points to keep in mind when you need to make this decision.

Note: This is a top-level guide and certain details may not apply to your specific business. Any final decisions should be made with the help of a tax or legal advisor.

Understanding the Different Types of Business Entities

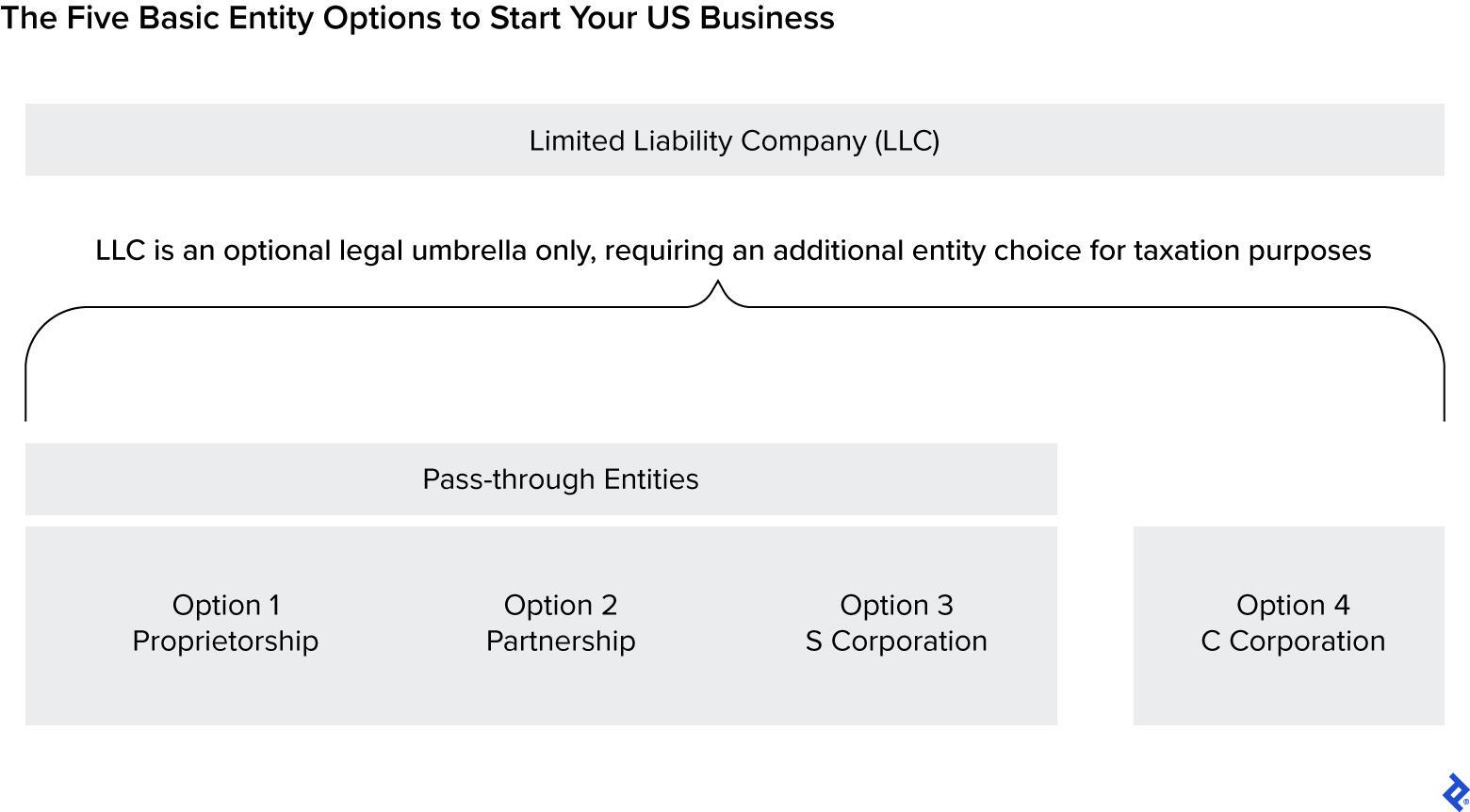

The IRS recognizes four main types of business entities: proprietorship, partnership, S corporation, and C corporation. These types have major differences when it comes to taxes, setup costs, administrative costs, and legal protections, but any of them can be formed as an LLC for liability assurance, then taxed as if they were one of the entity types recognized by the IRS.

Before we dive into the business entity types or discuss LLCs, however, it’s important to understand pass-through entities.

What Are Pass-through Entities?

Proprietorships, partnerships, and S corporations are all pass-through entities. They are called that because their taxable income “passes through” to the personal tax returns of the owners and is taxed there.

S corporations and partnerships do file company tax returns, but these returns simply display the company’s taxable income and allocate that income to the owners on a Schedule K-1 (Form 1065). Each owner’s Schedule K-1 amount is then reported and taxed on their personal tax return—Form 1040—as well as on any state and local returns that may apply.

In contrast, sole proprietorships don’t file a business tax return at all. The business income is calculated directly on Schedule C, Schedule E, or Schedule F of the owner’s personal Form 1040.

Pass-through status is significant because the owners of a pass-through entity pay personal income tax on the profits of the company, but they can then withdraw those profits as tax-free dividends from the company. This is not true of C corporations, which not only pay their own income tax but also hold taxable dividends. Essentially, the C corporation pays tax on its income first, and the remaining money is distributed to the stockholders, who pay personal income tax on it. This is referred to as double taxation.

Example: Taxation of S Corporation vs. C Corporation Earnings | ||

|---|---|---|

S Corporation | C Corporation | |

Taxable income | $1,000,000 | $1,000,000 |

Corporate tax rate | N/A | 21.0% |

Top individual tax rate | 37.0% | N/A |

Tax owed by corporation | $0 | $210,000 |

Tax owed by owner | $370,000 | $0 |

After-tax cash remaining | $630,000 | $790,000 |

Tax rate on distribution to owner | 0.0% | 23.8% |

Additional tax owed on dividend distribution | $0 | $188,020 |

Net after-tax cash remaining | $630,000 | $601,980 |

At a large company, the double taxation problem that a C corporation faces is mitigated by this entity’s other benefits, such as the low tax rate on corporate profits and unlimited shareholder allowance. For most small to midsize businesses, though, the cons of a C corporation will generally outweigh the pros.

Now that we’ve established that key distinction between S and C corporations, let’s look at the different entities in greater depth.

What Are Sole Proprietorships?

Fundamentally, sole proprietorships are intended for simple businesses owned by one person or a married couple. Such businesses are typically freelance businesses, consultancies, small service businesses, food stands, etc. Sole proprietorships don’t have shares or ownership units, meaning that the only exit option is to sell the assets of the company.

Sole proprietorships are by far the simplest business structure. A bona fide business that starts without formally incorporating is, by default, a sole proprietorship or partnership (depending on the number of owners). Sole proprietors with no employees don’t even need to register with the Internal Revenue Service (IRS). The owner can simply use their Social Security number as the business tax ID. Some points to be aware of:

- Business expenses are deductible. Contrary to popular belief, there’s generally no need to “incorporate” to deduct business expenses. Even an unincorporated sole proprietorship is eligible to deduct its business expenses.

- Proprietors pay personal income tax on profits. Proprietors cannot pay themselves wages. They simply withdraw company profits as needed. Each year they owe personal income tax on the entire taxable profits of the business, regardless of whether they have withdrawn the profits or not.

- Profits are subject to FICA tax and federal income tax. As of 2023, FICA tax (which pays for Social Security and Medicare) is 15.3% of income up to the Social Security limit of $160,200 and 2.9% of income earned beyond that. There is also the additional Medicare tax of 0.9% that applies after self-employment earnings exceed $200,000 for single taxpayers. In my experience, many small sole proprietors end up owing more FICA tax than federal income tax, but this depends on individual circumstances.

Pros and Cons of Sole Proprietorships | |

|---|---|

Pros ✔️ |

Cons ❌

|

Very easy to set up | All profits subject to FICA tax |

Easy for most owners to understand | Owner’s personal assets are not protected, unless company is formed as an LLC |

Separate business tax return not required | |

No payroll to run if there are no employees | |

What Are Partnerships?

A partnership is essentially the multi-owner version of a sole proprietorship. Most states require very little (if any) paperwork to form and maintain a partnership. This circumstance alone is the reason many relatively simple, early-stage businesses that have yet to achieve significant profitability are organized as partnerships, rather than formal corporations.

The arrangement can be especially attractive for small companies without employees, in which the owners do most of the work. Partnerships are also commonly used for real estate holding companies (because rental income is not subject to FICA tax regardless of entity type) and certain professional service firms, such as accounting firms.

Even though paperwork requirements for a partnership are minimal, multi-owner companies are by nature more complicated than sole proprietorships, so it is extremely important to have a partnership operating agreement that controls the operations and ownership of the company. Here are the major financial considerations you will need to plan for as well:

- Profits don’t have to be divided equally. Unique to partnerships, the business income doesn’t need to be allocated proportionate to ownership. This flexibility can be helpful when there is a silent partner who contributes most of the initial capital but isn’t expecting a commensurate share of the profits. Any such arrangement must be clearly laid out in a partnership agreement.

- Partnership income is generally subject to FICA tax. As with sole proprietorships, a major downside of partnerships is that the entire taxable income of a partnership is generally subject to FICA tax. This is a key reason most larger, highly profitable companies aren’t partnerships—the tax burden simply becomes too high.

- Payments to partners are not wages. Part of the simplicity of a partnership is that partners do not receive wages, but rather guaranteed payments for their services.

- The partnership doesn’t need to run payroll or file payroll reports if there are no non-owner employees. This can save the partnership the significant cost and hassle of payroll services and associated fees. Depending on the size of the company, the savings here may help to offset the increased FICA tax burden and make the partnership arrangement more enticing.

Pros and Cons of Partnerships | |

|---|---|

Pros ✔️ |

Cons ❌

|

Easy to set up and administer | Profits generally subject to FICA tax |

Easy for most owners to understand | Owners’ personal assets are not protected, unless company is formed as a limited partnership or LLC |

Flexible profit allocation allowed | |

Nopayroll to run if there are no employees other than partners | |

What Are S Corporations?

As companies become more profitable, proprietorships and partnerships tend to be less suitable due to how they’re taxed. Enter S corporations, a popular entity choice for small and midsize privately held companies.

Although both partnerships and S corporations are pass-through entities, the latter are typically favored by larger businesses because of FICA tax. S corporation owners are required to pay themselves a reasonable wage (subject to FICA tax), but the remaining business profits are subject only to income tax, not FICA tax.

Consider a business that makes $1,000,000 per year. Let’s say the owner receives compensation of $100,000 and the remaining $900,000 is business profit. The chart below shows how moving from partnership to S corporation status would save the owner approximately $31,000 per year in FICA tax, all else being equal.

FICA Tax on Total Earnings/Owner Compensation | ||

|---|---|---|

Partnership | S Corporation | |

Taxable income before owner compensation | $1,000,000 | $1,000,000 |

Owner wages | N/A | $100,000 |

Owner’s guaranteed payments | $100,000 | N/A |

Remaining business-taxable income | $900,000 | $900,000 |

FICA tax on owner wages | $0 | $15,300 |

FICA tax on owner’s guaranteed payments | $15,300 | $0 |

FICA tax on remaining taxable income | $31,346 | $0 |

Total FICA tax owed | $46,646 | $15,300 |

Note 2: Calculations are based on 2023 FICA tax thresholds.

While this benefit seems striking, for a very small company it may not be worthwhile. The requirement to pay a reasonable wage means even a “solopreneur” with no employees must run payroll and file payroll tax reports with the IRS (and the state, if applicable). The added administrative burden and cost of handling this and managing other requirements make this a disadvantage compared to partnerships and sole proprietorships.

S corporations are also generally subject to stricter rules than the other entity types. For example:

- Generally, only individual US residents and citizens can own an interest in an S corporation. Some exceptions exist for certain trusts and estates to be allowed as stockholders.

- Profits and distributions must be allocated according to ownership.

- Loss utilization can be limited. In some cases, an owner of an S corporation that has losses may not be able to deduct that loss on their personal tax return. The loss would have to be carried forward to a future year.

- Only one class of stock is allowed. There can only be voting and nonvoting shares—no others.

- There is a maximum of 100 stockholders for S corporations.

The legal conditions for setting up and maintaining S corporations usually require the help of a lawyer and/or accountant, which increases the associated costs. Despite these potential drawbacks, the FICA tax savings are hard to beat, accounting for the popularity of S corporations. S corporations also shield the owners’ assets from liability in the event of legal claims—something proprietorships and partnerships do not do. Also, by forming an LLC that elects to be taxed as an S corporation, you can avoid some of the rigid legal requirements.

In some cases, a partnership can be more tax-efficient than an S corporation, even after factoring in FICA tax. In this scenario, the partners forgo paying themselves guaranteed payments and instead treat all payouts as distributions. There are significant caveats to adopting this approach—you need to work with a tax expert to see if it’s right for you—but it’s common enough that I would be remiss if I didn’t mention it.

Pros and Cons of S Corporations | |

|---|---|

Pros ✔️ |

Cons ❌

|

Earnings beyond wages not subject to FICA tax | Full legal setup required |

Corporate legal shield function | Sometimes difficult for owners to understand |

Rigid profit allocation and distribution rules | |

Limited deductibility of losses | |

Only a person (not an entity) can own shares | |

Maximum of 100 stockholders | |

Generally must be owned by a US citizen | |

Payroll must be run even if there are no non-owner employees | |

Only one class of stock allowed | |

What Are C Corporations?

As businesses continue to get bigger and more complex, they may outgrow the S corporation structure. If the number of investors exceeds the 100 stockholder limit (as with a publicly held company), or if different share class structures are required, then it’s time to consider the C corporation.

All large American publicly traded corporations are C corporations. Privately held C corporations are rare and typically utilize the structure for reasons other than income tax concerns.

High-growth startups seeking series funding often utilize the C corporation structure. These private companies are forced to go this route because their target investors may be entities or foreign individuals, neither of which are allowed to invest in an S corporation.

While US companies may register in any state or territory, it’s common for C corporations to choose Delaware as its well-defined and court-tested corporate regulations have made it the state of choice for incorporation. According to the State of Delaware, more than 68% of Fortune 500 companies are domiciled there.

One significant drawback of the C corporation structure is the double taxation issue we looked at in our discussion of pass-through entities—the company pays tax on the income, and then stockholders pay tax on their dividends.

Furthermore, C corporation losses cannot be deducted against stockholders’ other personal income. The combination of these pitfalls discourages many private firms from adopting this structure.

In short, the idea of using the C corporation structure for tax optimization has merit in specific situations. For most small to midsize businesses, though, the cons will generally outweigh the pros.

Pros and Cons of C Corporations | |

|---|---|

Pros ✔️ |

Cons ❌

|

Low tax rate on corporate profits | Full legal setup required |

Corporate legal shield function | Double taxation of corporate profits |

Unlimited stockholders allowed | Limited deductibility of losses |

Stockholders may include such entities as trusts and funds | |

Potential for tax-free sale of stock upon exit | |

Now that you have a sense of the characteristics of the four main business entity types recognized for tax purposes, let’s look at whether becoming an LLC makes sense for your company.

What Are Limited Liability Companies (LLCs)?

As the name suggests, a limited liability company is a business structure that offers “limited liability” to owners of the company and informs the world that the owner is not personally liable for claims.

An LLC is a legal entity only and is not recognized by the IRS as a taxpaying business structure. For tax purposes, if the owner decides to form the company as an LLC they must also decide whether it’s going to be a C corporation, S corporation, partnership, or proprietorship.

It’s completely acceptable to organize as any of the four business entity types we’ve discussed without being an LLC. Why, then, does it seem like almost all new companies are formed as LLCs?

- The LLC structure helps shield the owner’s personal assets from a lawsuit against the business. In other words, without an LLC, a sole proprietor or partner may be personally liable for a lawsuit or judgment that exceeds the business assets. That event would subject the owner’s personal assets to potential claims.

- Compared to traditional S or C corporations, an LLC structure is generally simpler to administer. Corporations are often required to hold annual meetings and keep records of meeting minutes; an LLC is generally not subject to these regulations, even when it’s taxed as a corporation.

- Starting out as an LLC gives a company flexibility for a later entity change. While a company can change its entity type without being an LLC, the simplified regulations and management of an LLC create less friction for conversion. For example, a common path is to form an LLC taxed as a partnership, then elect S corporation status after the company becomes profitable.

LLCs and business entities are formed at the state level. Accordingly, the exact process for setting up a new company varies by state, and may entail various fees. Corporate governance and reporting requirements can vary slightly by state as well.

What does not vary is federal tax law. Each entity type is subject to specific federal tax laws that apply to all US companies of that type, regardless of the state it is registered in.

Partnership, Proprietorship, C Corp, S Corp: In Review

Again, the three main considerations when choosing a business entity are how profits are taxed, administrative cost and complexity, and liability.

From a tax standpoint, the S corporation may be optimal, since it offers a single layer of taxation (unlike C corporations) and earnings are not subject to FICA tax (unlike partnerships and proprietorships).

Sole proprietorships are ideal when you’re considering the cost and complexity of setup and maintenance. They are by far the least complicated and have the lowest cost of setup and ongoing governance and administration. But for a multi-owner company formed as an LLC, a partnership is sometimes preferable for flexibility.

Finally, from a liability standpoint, the LLC structure is hard to beat. It offers liability protection along with any of the four entity structures. A non-LLC S corp or C corp can also offer solid protections from a liability perspective.

Comparison of Business Entity Options | ||||

|---|---|---|---|---|

Proprietorship | Partnership | S Corporation | C Corporation | |

Federal tax rate on profits (2023) | 10%-37% | 10%-37% | 10%-37% | 21% |

Subject to double taxation | No | No | No | Yes |

FICA tax on profits | Yes | Yes | No | No |

Cost of Setup/Ongoing Administration | Low | Moderate | High | High |

Liability protection | No | Generally no | Yes | Yes |

Advantage of LLC umbrella | Liability protection | Liability protection | Simpler governance | Simpler governance |

Which Entity Type Should You Choose for Your Business?

To help you understand the thought process behind choosing an entity type, I’m going to use four fictional companies to explore how different entity types can be beneficial depending on how a business is constructed and what the stakeholders want.

1. A Summer Side Hustle

Joe’s Mowing

- Joe is a 21-year-old college student looking for additional income. He has decided to start a small lawn care business.

- Joe is planning to purchase equipment worth $5,000 and is hoping to turn a profit of $15,000 for the summer.

- Joe’s Mowing will have no employees other than Joe.

Which Entity Type Is Right for Joe’s Mowing?

As a young entrepreneur with a short-term business plan, Joe is a perfect candidate for a sole proprietorship. An S corporation would require significant cost to set up, and he would have to pay himself a reasonable wage (subject to FICA tax). His wage would likely wipe out his $15,000 profit, which would negate any FICA savings. Plus the hassle of running payroll would not be worth it. An LLC umbrella would add liability protection if Joe felt he needed that.

2. A Family-owned Apartment Complex

LBD Group

- Lucia, Ben, and Dorcas are siblings who own equal percentages of an apartment complex.

- Lucia is a silent investor; Ben and Dorcas manage and maintain the property.

- Lucia has agreed that she does not need to receive an equal share of the profits, because she is contributing nothing but capital to the project.

Which Entity Type Is Right for LBD Group?

An LLC taxed as a partnership would clearly be the best option for LBD Group. Since rental income is not subject to FICA tax, the S corporation advantage doesn’t apply. Partnerships allow profits to be distributed unequally to owners, which is a goal of this group. There are no non-owner employees, which means no payroll would be required if the entity were a partnership. And given the liability issues in the real estate business, an LLC would offer protection to the owners in the case of a lawsuit.

3. A Married Couple’s Fledgling Family Business

Brilliant Ideas

- Brilliant Ideas is a new copywriting business founded by Bill and Malia.

- Its first short tax year, including only the months since the company’s founding in June, is going to end with a net loss of $10,000.

- However, the couple believes next year will be profitable to the tune of $250,000.

Which Entity Type Is Right for Brilliant Ideas?

With losses this year, and an anticipated $250,000 in profit next year, Bill and Malia appear to be perfect candidates for forming an LLC and electing to be taxed as a proprietorship or spousal partnership this year, then electing S corporation status next year. That way they can use this year’s business losses to offset wages or other income. Next year they will draw wages from the S corporation, and the remaining profits will not be subject to FICA tax.

4. A Fintech Startup Run by Several Entrepreneurs

FreeBooks

- Led by a small team of entrepreneurs, FreeBooks is an early-stage fintech startup.

- The founders are seeking private equity investors.

- The goal is to be on the market within a year and be a relevant player within three years, with several capital infusions along the way.

Which Entity Type Is Right for FreeBooks?

As a classic technology startup hoping to receive venture capital or private equity funding, it has little option other than to be a C corporation. The other types of entities wouldn’t allow the complex share class and ownership structures these types of companies require. The only other structure to consider would be to form first as an LLC taxed as a partnership or S corporation, then switch to C corp status when the corporate investors become a reality. In this scenario, structuring the company as an LLC would be greatly beneficial as it would allow more flexibility for these entity changes, keep things simple early on, and allow early investors to deduct losses on their personal tax returns.

Changing Your Entity Type to Fit Future Needs

Starting your company is exciting, but it’s also a time to be cautious and make sure you’re doing things right. Before you choose an entity type, reach out to your tax advisor for direction on your specific situation.

While difficult, it is possible to change your company’s legal structure and business entity type further down the line as your needs and profitability change. For example, if you’re starting a traditional business (service, manufacturing, retail, etc.) with co-owners and employees, consider an LLC taxed as a partnership to start, then elect S corporation status when it gets relatively profitable. That provides the flexibility of a partnership upfront and avoids FICA tax on profits once revenue starts flowing. Just keep in mind that switching can have tax implications and result in a sizable administrative burden.

Ensure that you do enough due diligence to correctly weigh all the pros and cons of the different options for your company. Getting your entity type right from the start will put your company on a sound footing to achieve its potential.

This article has recently undergone a comprehensive update to incorporate the latest and most accurate information. Comments below may predate these changes.

Further Reading on the Toptal Blog:

- Advanced Financial Modeling Best Practices: Hacks for Intelligent, Error-free Modeling

- The Metrics Investors Want: Quantitative Forecasting for Early-stage Startups

- Strategic Financial Leadership: 6 Skills CFOs Need Now

- Startup Financing for Founders: Your Companion Checklist

- Don’t Scale an Unprofitable Business: Why Unit Economics (Still) Matter

Understanding the basics

What is the difference between a C corp and an S corp?

One major difference is how they are taxed. C corps pay income tax on their corporate tax returns, and stockholders must generally pay income tax on any dividends they receive. C corps permit a wider range of stockholder types than S corps, giving them greater flexibility when seeking investors. S corp income flows to stockholders and is taxed on their personal tax returns. Dividends paid to S corp stockholders are not taxable.

Is a C corp better than an S corp?

Many privately held companies are organized as S corps so that their owners can avoid the double taxation of C corps. However, S corps have strict stockholder eligibility rules, making the C corp structure more attractive to large companies seeking institutional or foreign investors.

Is an S corp suitable for small businesses?

S corp status is suited to profitable startups that meet certain requirements, especially if these startups don’t fit the C corp specs. If your business is a simple small business that is not expected to earn much more than a reasonable wage for you as the owner, you may wish to consider forming an LLC taxed as a proprietorship, as the benefits of S corp status (if any) likely will not exceed the cost of processing payroll for yourself and filing a separate business tax return.

Stratford, WI, United States

October 31, 2018

About the author

Scott is a seasoned CPA and interim CFO who has helped clients achieve financial clarity in a wide range of industries. He specializes in high-level monthly financial oversight, accounting software projects, and corporate tax planning.

Previous Role

Interim CFOPREVIOUSLY AT