Don’t Scale an Unprofitable Business: Why Unit Economics (Still) Matter

With venture funding having grown more than 120% in the US in the last five years, startup founders and investors alike have grown increasingly comfortable with low margin business models. But the successes of the Amazons and Facebooks of this world often mask failure in a slew of other sectors, where the “build it and they will come” model doesn’t always work.

In this article, Toptal Finance Expert Toby Clarence-Smith brings attention back to the importance of studying a business’ long-term sustainability prospects, with a particular focus on unit economics, one of the building blocks of profitability and breakeven analysis for startups.

With venture funding having grown more than 120% in the US in the last five years, startup founders and investors alike have grown increasingly comfortable with low margin business models. But the successes of the Amazons and Facebooks of this world often mask failure in a slew of other sectors, where the “build it and they will come” model doesn’t always work.

In this article, Toptal Finance Expert Toby Clarence-Smith brings attention back to the importance of studying a business’ long-term sustainability prospects, with a particular focus on unit economics, one of the building blocks of profitability and breakeven analysis for startups.

Toby has deep financial experience across investment banking, VC investing, and PE. He most recently founded and sold a VC-backed company.

Expertise

PREVIOUSLY AT

Executive Summary

Unit Economics Measure the Intrinsic Profitability of a Company

- What is the meaning of unit economics? Unit economics are a measure of the profitability of selling one unit of your product or service.

- The way in which they can be calculated vary according to how one defines a unit, but if a unit is defined as one sale, then the commonly associated metric is Contribution Margin, whereas if a unit is considered as a customer, then the most relevant metrics would be Customer Lifetime Value (CLV) and its relationship with Customer Acquisition Costs (CAC).

- The key distinction from other, more traditional measures of profitability is that unit economics only considers variable costs and ignores fixed costs.

- In so doing, unit economics can help determine the output level at which a business must be operating at in order to cover its fixed costs. As such, unit economics is a fundamental part of breakeven analysis.

Including All Variable Costs Is Key to Getting the Analysis Right

- The most common mistake related to unit economics is omission of quasi-variable costs from the calculation.

- Variable costs are those that are directly tied to sales, and that therefore vary with output.

- While some variable costs are obviously so (e.g., COGS, shipping and packaging costs for eCommerce companies, sales costs for enterprise/B2B startups), many are not quite as clear and often get archived as fixed costs mistakenly.

- Examples of such quasi-variable costs could be: customer service representatives, the cost of returns, technology costs, etc.

- In doubt, founders should err on the side of caution and include as many costs as possible in their unit economics analysis in order to avoid unwanted cash burn surprises.

Absolute Numbers Matter

- Another common mistake is focusing on profitability margins and CLV/CAC ratios without remembering that the absolute numbers underlying these calculations still matter.

- Higher ticket sizes, and therefore higher absolute profits, will help companies grow more easily into their fixed cost base, which are often similar regardless of the ticket sizes involved.

- This is especially true since in reality there is no such thing as a fixed cost. All fixed costs vary with output to a certain degree, meaning that very small absolute profits make it more difficult to catch up with fixed costs as output grows.

Scaling Unprofitable Businesses Doesn't Make Sense

- With the frothy market conditions, the amount of founders pitching businesses that are unprofitable on a variable cost basis has increased dramatically.

- Banking on improvements of one's unit economics with scale is a risky strategy. Prices are sticky, customers are less loyal than one might hope, and cost rationalization becomes difficult once company processes and teams have been in place for a certain amount of time.

- The whole point of unit economics analysis is to show profitability on a variable cost basis so that one can foresee a credible path to profitability. It's fine for startups to lose money at first, but there needs to be scope to grow into a company's fixed cost base. If a company loses money before fixed costs, the scope to do so is far more limited (if not impossible).

Study Your Unit Economics to Maximize Your Chances of Success

- Hire an interim CFO to help assess your business' intrinsic profitability prospects, and more importantly, how you can improve your chances of breakeven. The best investors will look out for this type of analysis, making your chances of raising funding far greater.

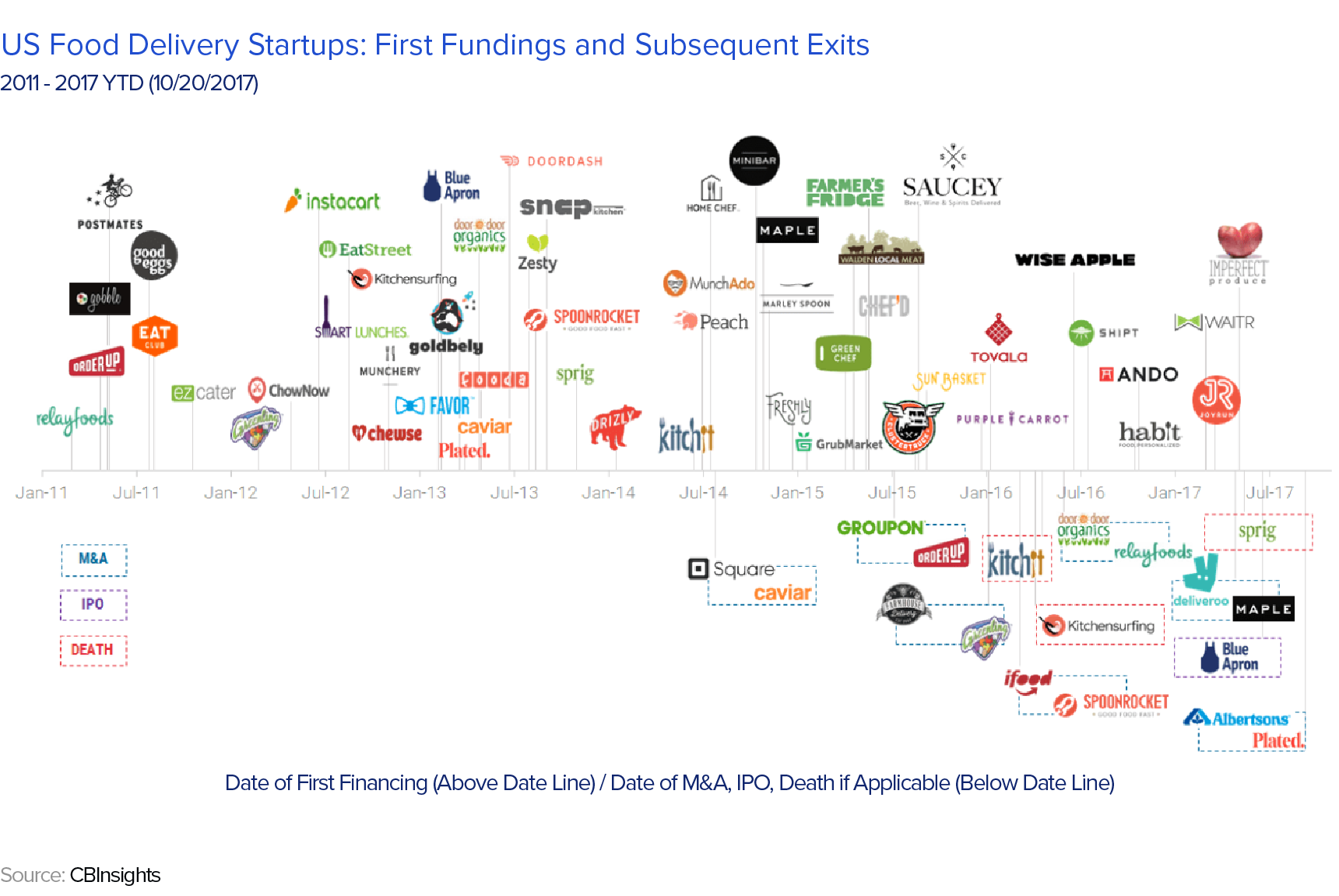

In 2010, 20 venture capital funds had invested in the then-nascent on-demand space. Over the following five years, that number exploded to more than 200, with “Uber-for-X” businesses cropping up in almost every single vertical imaginable. One of the most prominent verticals in the on-demand space was food delivery. Some companies (DoorDash, Postmates, Caviar) delivered food from restaurants that didn’t have their own couriers. Some (Spoonrocket, Sprig) made the meals themselves. Others (Munchery, Blue Apron) delivered meal kits that were either ready to be heated, or had to be cooked by the customer. Whatever the spin, the concept was simple: Allow customers to order food via an app, deliver it (relatively) fast, sit back, and watch the business scale.

But as is often the case, the hype wore off, and soon many of the well-funded startups started to shut down. The New York Times proclaimed the “end of the on-demand dream” while Pandodaily chronicled the coming “food-pocalypse”. In a May 2017 article, Quartz quipped “For years now, we have been living in a golden era of VC-subsidized meals. As startups piled into the food delivery space, they showered customers with coupons and promotional offers made possible by generous investor financing…[But] It seems that in the end people were less excited about the speed, convenience, and slick interfaces…than they were about having their meals delivered for absurdly low prices. In that sense the last three years have been less an innovation than a giant wealth transfer, from the VCs and startups they funded to the lucky consumers who got a free lunch along the way.”

What happened? Usually, the reasons why startups shut down are many and varied, but in this case it seems fairly clear that one reason stood out above them all: poor unit economics. On-demand food delivery startups were simply not profitable and couldn’t make their business models work, even at scale.

In an age when profitability is almost a dirty word amongst startup founders, the fate of the food delivery market should serve as a useful reminder that profit margins, even in Silicon Valley, still matter. Legendary venture capitalist Bill Gurley said so himself, in an ominous interview in 2015: “One thing that happens in Silicon Valley—and this has been highly cyclical—the more we get into peak-y [valuations] territory, the more optimistic we get about business models that are lower margin.”

But investing in and scaling unprofitable businesses doesn’t make sense. If a business loses money on every sale, then growing that business will only increase the amount of money that is lost. And yet I am continuously surprised by the number of founders who fail to internalize this. Having founded and sold an eCommerce company, and then moved over to the investing side, I see time and time again how startup founders embrace the “scale it first, make it profitable later” mentality without spending any time thinking about whether their business can actually ever be profitable.

The point of this article is to call attention back to this, and in particular to one of the most useful ways startup founders can think about their business’ potential profitability: unit economics. By running through some of the biggest issues I’ve encountered, I hope to impart some useful information, not just so founders can improve their prospects of fundraising, but more importantly so that they can make informed decisions about whether they should really be investing years of their lives at extreme personal and financial cost into businesses that might never make any money.

What Are Unit Economics and Why Are They Important?

Simply put, unit economics are a measure of the profitability of selling/producing/offering one unit of your product or service. Think of it as unit profitability: Positive unit economics suggest you have a viable product. If you’re a widget company selling widgets, the unit economics will be a relationship between the revenue you receive from selling a widget and all the costs associated with making that sale. For companies offering a service, for example Uber, the unit economics will be the relationship between the revenue from their service (e.g., one taxi ride) vs. the costs associated with offering and servicing the customer.

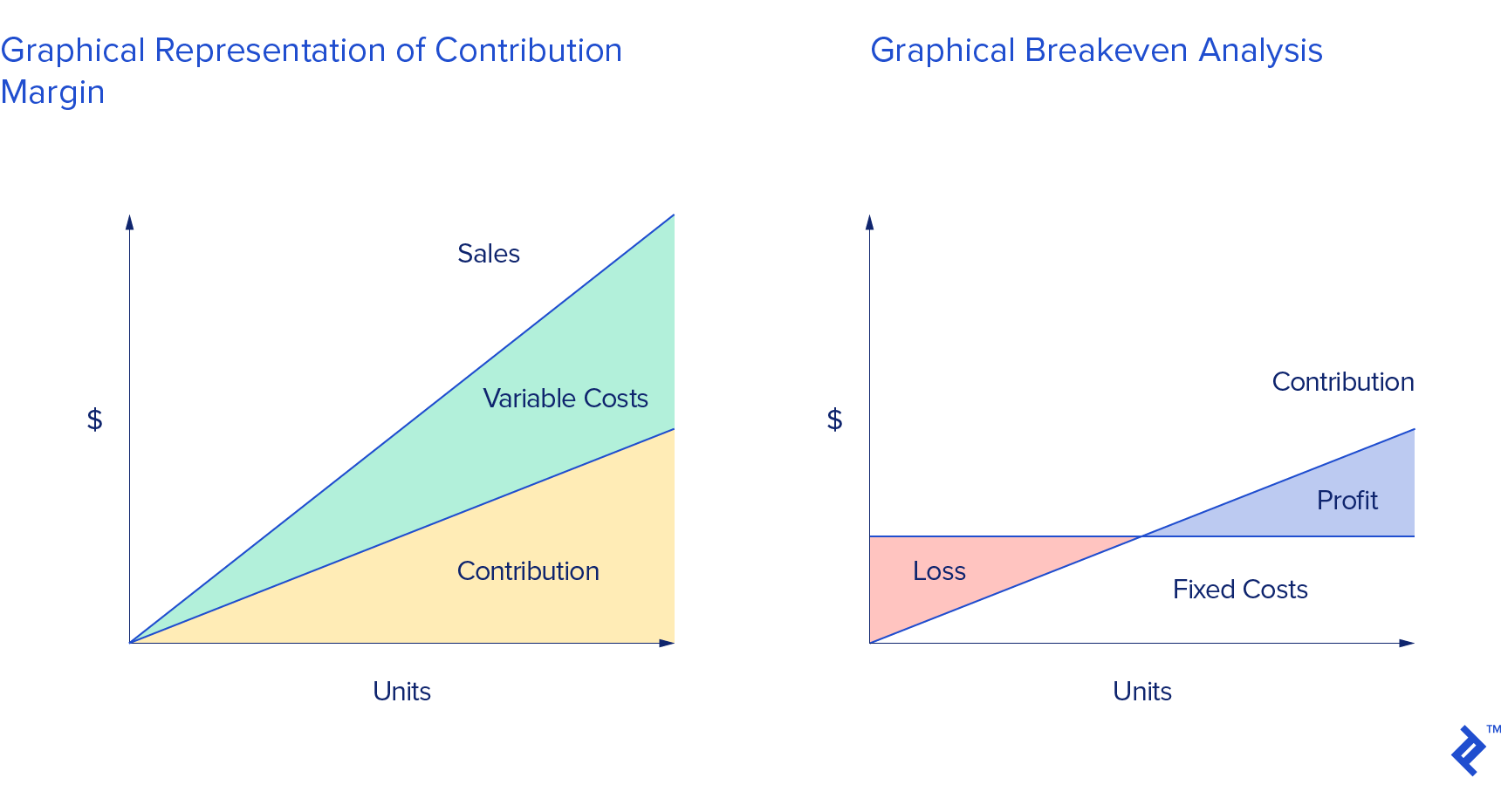

At a high level, the point of unit economics is to understand how much profit a business makes before fixed costs so that one can estimate how much a business needs to sell in order to cover its fixed costs. Unit economics are thus a fundamental part of breakeven analysis.

For startups that are still in growth mode, this sort of analysis is crucial. It charts a path that the company can follow in order to wean its way off external equity funding. Figure 2 below displays this graphically. As volumes increase, profits before fixed costs (named “contribution” in the chart) tick up and to the right, eventually crossing paths with the fixed cost line. The point in which they cross is the breakeven point.

Going deeper, there are two ways one can approach the calculation of unit economics, and the key differentiating factor is how one defines a unit. If one were to define a unit as one item sold, then the unit economics becomes a calculation of what’s commonly referred to as the contribution margin. Contribution margin is a measure of the amount of revenue from one sale that, once stripped out all the variable costs associated with that sale, contributes toward paying fixed costs.

Contribution margin = Price per unit - variable costs per unit

If instead one defines a unit as one customer, then the commonly calculated metrics are customer lifetime value (CLV) and its relationship with customer acquisition costs (CAC). In essence, these are the same as contribution margin, in that they express the profitability of one customer vs. the cost of acquiring said customer. But the main difference is that they are not fixed in time. Rather, CLV measures the total profit generated by a customer throughout the lifetime of that customer’s relationship with the company. The reason this is important is that startups naturally have to invest in acquiring customers, often at a loss on the first sale. But if the customer makes multiple transactions with the company in time, the company will be able to recoup, and hopefully make a substantial return on the initial investment.

A more detailed explanation/tutorial of what unit economics are and how to calculate them are beyond the scope of this article. But for those who are new to unit economics and how to calculate them, here is a good introductory post on contribution margin, and here are two on CLV and CAC. The latter are admittedly more focused on eCommerce, but the general principles stand for any business. And in any case, the web is awash with tutorials on how to calculate these metrics. For those who want to really nerd out about unit economics, I recommend reading Peter Fader’s work, widely considered the guru on the subject (and incidentally, my old business school professor).

Common Mistakes Founders Make with Unit Economics

To be fair, most founders do have a basic understanding of unit economics and usually include this as part of their conversations with investors. Many startups in fact focus their entire value proposition around improvements in the unit economics of their vertical, common examples being the direct-to-consumer startups that we recently covered in a fascinating article on the mattress industry.

But what has often surprised me is the level of superficiality with which founders in many cases approach the subject. They do the analysis because they have to, but don’t really internalize what unit economics aim to assess and why they are important. In particular, I’ve encountered three common sets of mistakes that founders make, and I’ve chosen to address these in greater detail in this article. (n.b., There are a surprisingly high number of investors who also don’t understand these principles.)

Understanding Which Costs Are Truly Fixed vs. Variable

By far, the biggest mistake people make when performing unit economic analysis relates to the cost side of the equation. As we saw above, whether you’re simply calculating your contribution margin or whether you’re doing a more ROI-based CLV/CAC analysis, a vital part of the equation is what costs you choose to discount from your revenue. In principle, the rule is simple: Unit economics only considers variable costs, not fixed costs. But in practice, the distinction between fixed and variable costs is often not so straightforward.

The textbook definition of a variable cost is that variable costs are those directly associated with sales. Variable costs therefore vary according to the volume of output. Common examples of variable costs are cost of goods sold (COGS), things like shipping and packaging costs for eCommerce startups, or sales costs for enterprise/B2B startups.

But while some costs are obviously variable, others aren’t quite as clear-cut. The cost of providing customer service is a common area of confusion. For many startups, the ability for customers to speak to a customer service rep is crucial, and thus becomes a vital part of the sales process. In such situations, customer service should be accounted for as a variable cost, especially since the size of the customer service team will naturally expand as sales volumes expand. The growth in customer service may not be 1:1, but the relationship is there, making this a variable cost that must be accounted for in unit economics analysis.

There are a multitude of other “quasi-variable” costs that often get mistakenly archived as fixed. For eCommerce companies, for instance, the cost of returns is a good example. Since many eCommerce companies offer free returns, and since all will have some level of returns per X number of sales, this therefore becomes a variable cost that again must be included. Technology costs are another example. There are many types of technology costs (e.g., server costs, software costs) that vary as sales and output increase.

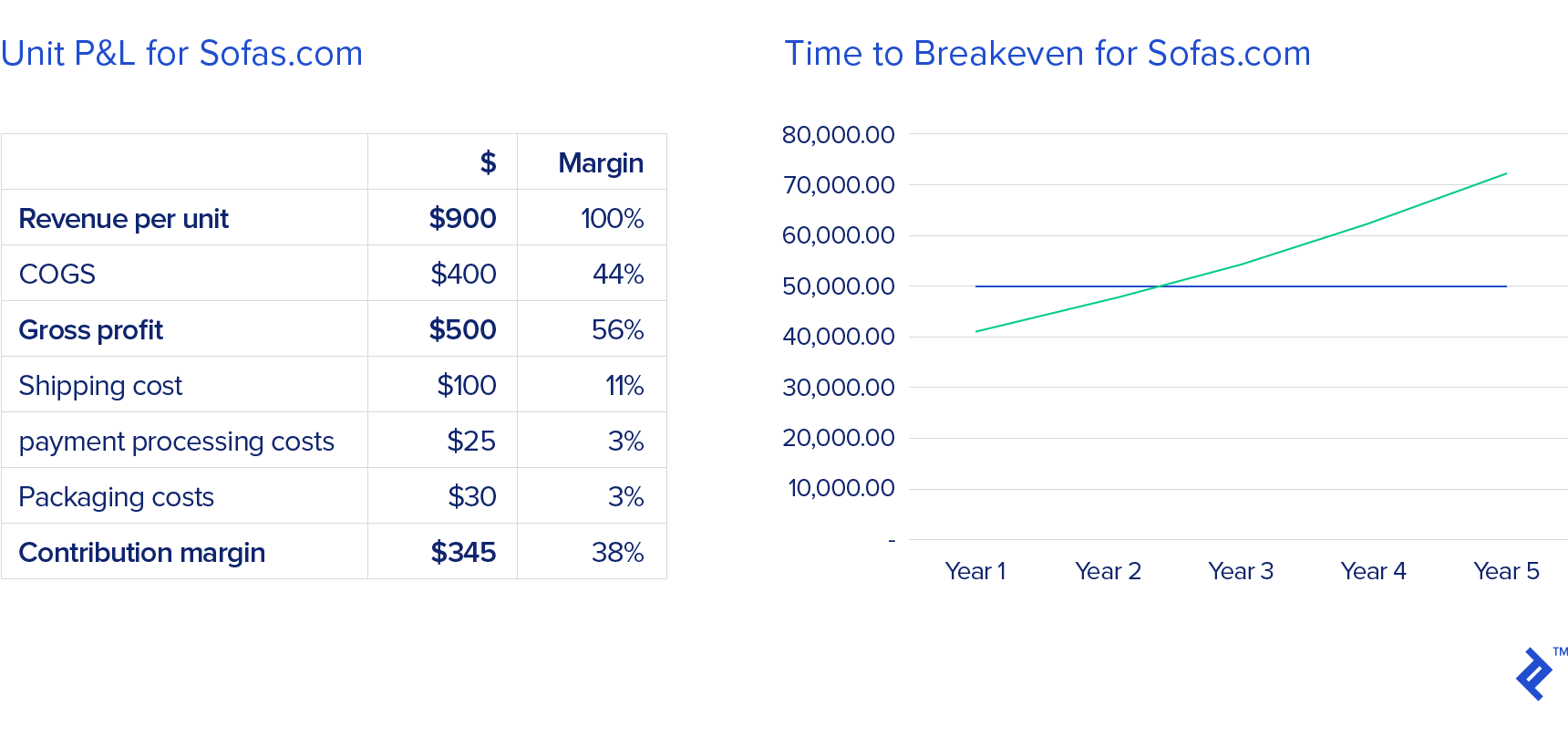

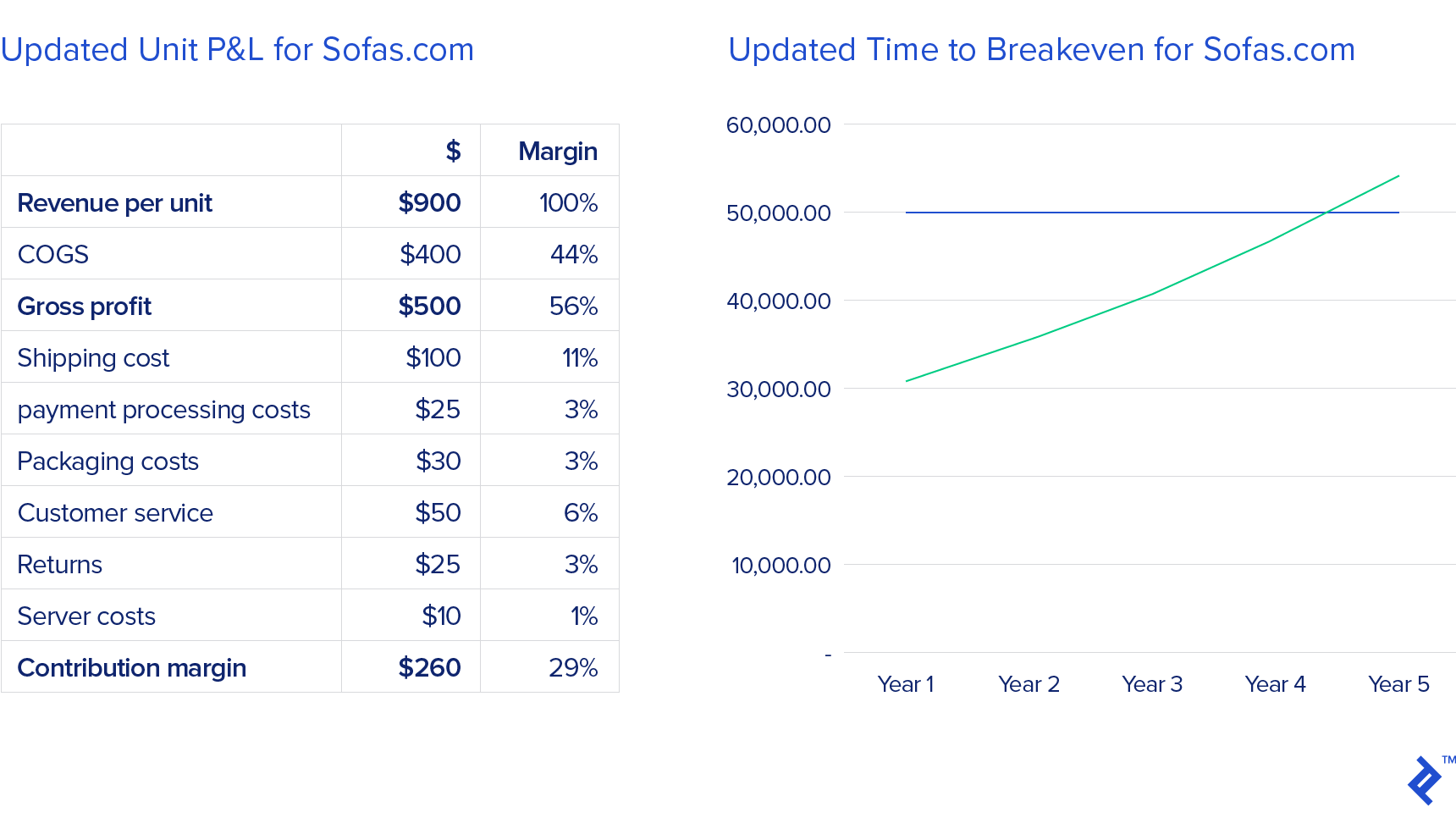

Being thorough about including all variable costs in an analysis of unit economics is vital because this can make a very material difference to the breakeven scenarios. Let’s look at an example to illustrate the point. Sofas.com is a fictional company selling sofas online. Their contribution margin calculation is shown in the table below. As one can see, sofas.com has a fairly straightforward business. For each sofa it sells, the company incurs four standard variable costs: COGS, shipping and packaging costs, and the payment processing costs of the payment provider it uses (e.g., Stripe or PayPal). With these variable costs, sofas.com seems to have a very healthy contribution margin of 38%. Assuming fixed costs of $50,000 per year and a linear growth trajectory, they would break even somewhere in Year 2. Not bad.

But if we now include other variable costs such as customer service, returns, and server costs, the picture changes substantially. The company’s breakeven moves out by two years!

My suggestion to founders, when in doubt, is to err on the side of caution. Include as many costs as you can in your unit economics. That way, you’ll only receive positive surprises rather than the other way around. It also forces you to pay attention to costs that you’d otherwise never think about since in the first two to three years you’ll spend little time thinking about fixed costs. If you mistakenly account for certain costs as fixed, you’ll find yourself further down the line struggling to understand why you’re cash burn isn’t looking like what your business plan was projecting (trust me, I’m speaking from experience).

Absolute Numbers Matter

Another common mistake founders make in their unit economics analysis is forgetting that absolute numbers matter. It can be tempting to focus exclusively on contribution margins as percentages or on CLV to CAC ratios. But the point is that larger absolute numbers tend to be very helpful! A large share of a small number may end up being less than a small share of a large number, and that matters when the fixed costs involved are the same in either scenario.

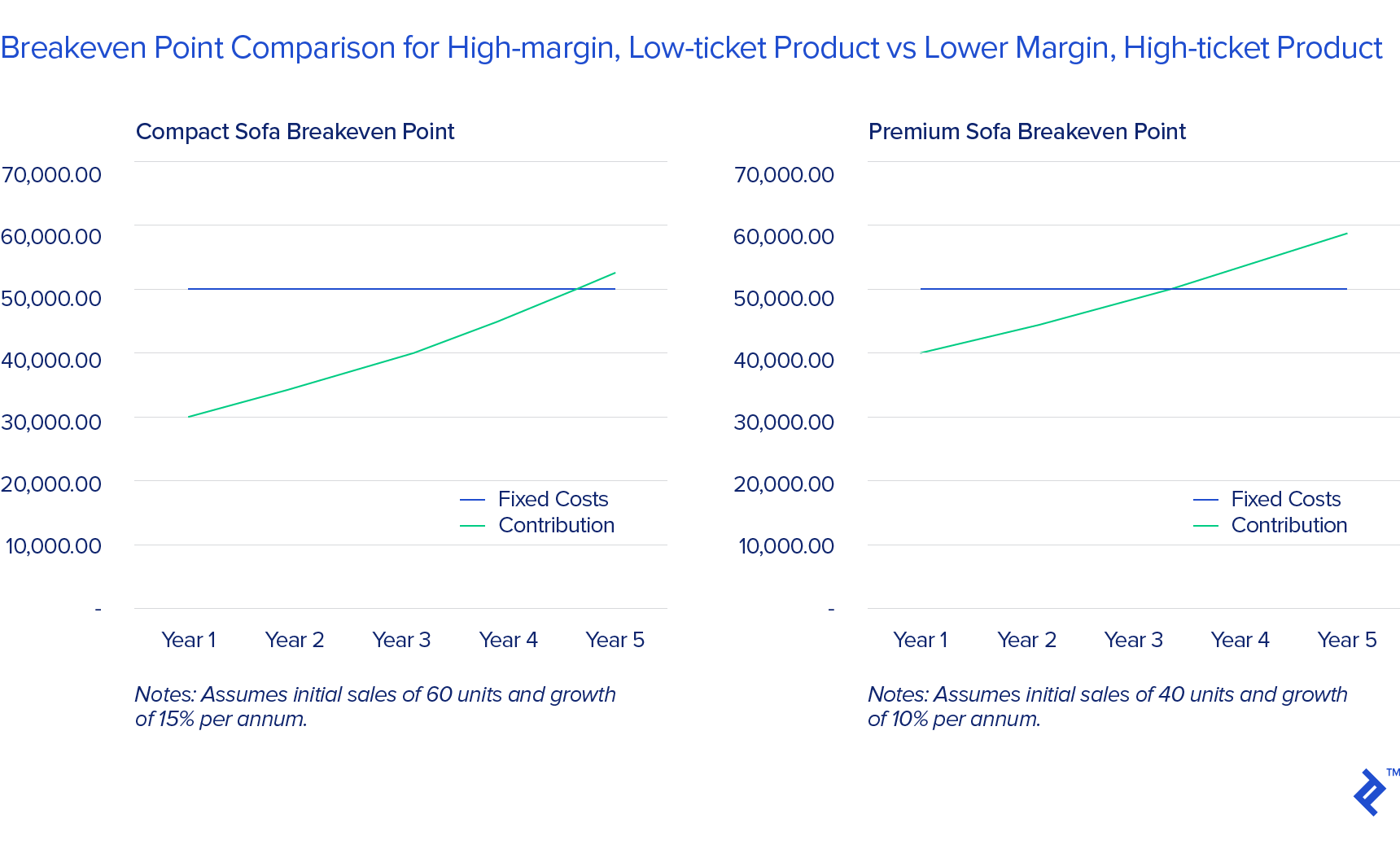

Let’s stick with sofas.com as our example to illustrate the point further. Imagine that sofas.com is just getting started, and has decided to only sell one type of sofa to begin with. The first option is a compact sofa made with cheaper fabrics that retails at $500. Management believes this will retail well with younger professionals who are just moving into their first apartment. The alternative would be to sell a much larger L-shaped sofa made from premium fabric which retails at $900 but only appeals to a smaller set of wealthier customers. The compact sofa has gross margins of 55% because the supplier is based overseas, whereas the larger sofa has much lower margins of 40% because the supplier is local and much of the work is done by hand. Given the larger margins and the bigger addressable market, sofas.com may be tempted to choose the compact sofa to start. But what they’re forgetting is that their fixed cost base is going to be exactly the same in both scenarios: they’re going to need the same size of office and the same size of team. Even accounting for a larger volume of initial orders and higher growth for the compact mass-market sofa, sofas.com may be better off selling the larger, more expensive sofa.

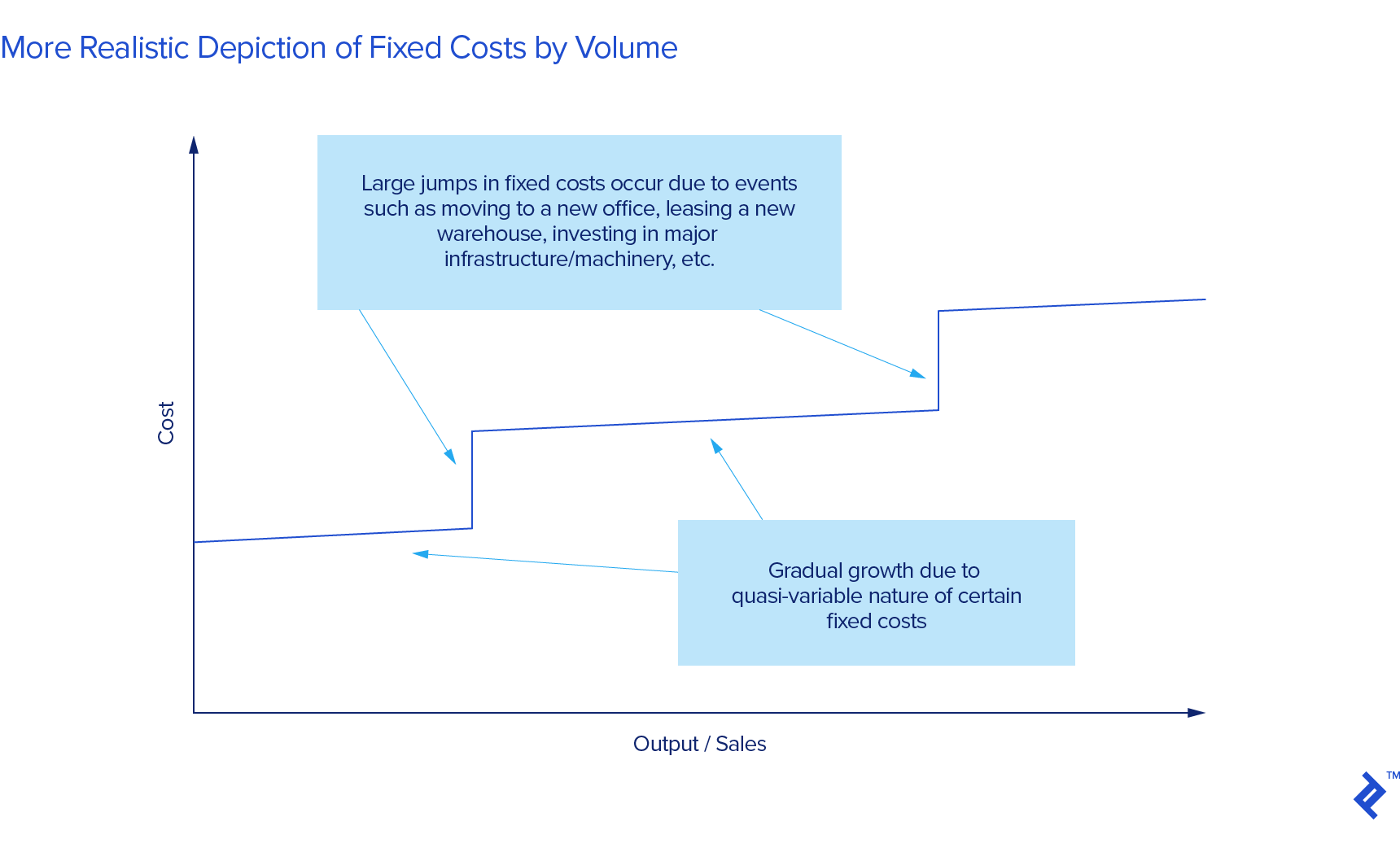

The overarching point about absolute numbers being important matters especially because in reality, there is no such thing as a fixed cost. Over the long term, all costs are variable. They just vary at different rates and on different schedules. Consider the cost of an office, the most commonly cited fixed cost: while the office may do for several years, as a businesses grows, it will at some point need to expand to larger offices. Same thing with supposedly fixed costs such as the size of your tech team. Just compare the size of the tech team at a large, Series C funded tech company versus a small Series A funded one. I guarantee you that the Series C funded company will have a considerably larger tech team.

So if fixed costs are never really fixed, selling products or services with large ticket sizes and therefore larger absolute profit numbers helps add more cushion to support the fixed cost base, making the promise of profitability that much more tangible.

Not All Cash Burn Is Created Equal

The third big issue I see related to unit economics is more fundamental, and pertains to a misunderstanding of the principles behind cash burn in startups and growth businesses. Taking a step back, why is it acceptable to burn cash? Why would VCs fund unprofitable businesses? Why would founders invest their time and energy into businesses that don’t make money?

There are fundamentally two reasons why it makes sense for both parties (management, investors) to back an unprofitable business.

Level up: The first acceptable scenario is when there has been an investment into a fixed asset (say, a piece of expensive machinery or the salaries of an expensive team) that makes the business unprofitable at its current output levels but allows the business to grow to a much larger output level than it otherwise would have been able to operate at. When the business eventually reaches this larger output level, it will be very profitable, perhaps more so than prior to the investment. In other words, you level up.

Go faster: The second reason is that both parties may simply be interested in reaching larger levels of output more quickly. The business could reach those output levels organically on its own, but it would take much longer. If management is willing to sacrifice part of their ownership in their business to go faster, then it’s a mutually beneficial arrangement for both parties.

Looking at the scenarios above, both imply investments, and consequently increases, in the fixed cost side of P&L, rather than the variable cost side. So burning cash because your business incurs larger fixed costs than your contribution or operating profit can sustain can be acceptable so long as there is a realistic path of growth and that, at some point, your contribution/operating profits will exceed the fixed costs and the business model makes sense again.

If you look at large public (or even private) companies, none of them do unit economics analysis (at least not publicly. They may do so internally but for reasons that are beyond the scope of this article). They do financial analysis the old-fashioned way, using P&L statements, cash flow statements, etc. The reason is simple: For larger, more established companies, the distinction between fixed and variable costs is irrelevant. They need to cover their costs, no matter what type they are.

Unit economics analysis exists precisely because startups turn this on its head and instead embrace a strategy of cash burn in the initial years to reach profitability later. But how do you show an investor that your business, which is burning cash now, will at some point stop burning cash? Unit economics. Unit economics analysis can illustrate in a clear and believable manner that your company is intrinsically profitable, and that you just need greater volume to cover your fixed costs.

With all this in mind, it baffles me when I see pitches for startups that are not profitable (or barely) on a variable cost basis. Showing a unit economics slide that omits key costs, or worse still, that is negative, completely defeats the purpose of such analysis.

To be fair, there are certain situations in which razor thin (or even negative) contribution margins might make sense. Here are some:

- Economies of scale: There are situations in which sales volumes make a material impact on your unit costs. An example would be in COGS, where retail businesses typically receive far more favorable terms from their suppliers at larger output levels.

- High ROIs on marketing: Certain businesses reap substantial returns on the acquisition of new clients over the lifetime of such clients. Investing in marketing, and thus losing money on a unit basis at first, may make sense so long as that investment returns significantly more in time. One needs to be sure about the ROI of this marketing expense, and CLV/CAC analysis is one way of assessing whether this strategy may make sense.

- Investing in customer service/loyalty: Similar to the above, certain businesses may be able to run thin margins on their first sale to a customer, because doing so creates loyalty and therefore increases the ROI of that customer.

But the above are all much riskier strategies than if your business had strong unit economics. So many things can go wrong. Customers are never as loyal as you think. Your ability to upsell or increase prices is far more limited than you might expect, particularly if you’ve acquired customers on the basis of discounted offerings, making them more sensitive to price than you’d like. Cutting costs and replacing people with technology is much more complicated than you anticipate. All of the common defenses of poor unit economics are relatively weak, and building your entire business case on these is a very risky path to take.

If you don’t believe me, here are some very well-respected and knowledgeable people who think the same.

One of the jokes that came out of the 2000 bubble was we lose a little money on every customer, but we make it up on volume…There are now more businesses than I ever remember to explain how their unit economics are ever going to make sense. It usually requires an explanation on the order of infinite retention (‘yes, our sales and marketing costs are really high and our annual profit margins per user are thin, but we’re going to keep the customer forever’), a massive reduction in costs (‘we’re going to replace all our human labor with robots’), a claim that eventually the company can stop buying users (‘we acquire users for more than they’re worth for now just to get the flywheel spinning’), or something even less plausible…

Most great companies historically have had good unit economics soon after they began monetizing, even if the company as a whole lost money for a long period of time.

Silicon Valley has always been willing to invest in money-losing companies that may eventually make lots of money. That’s great. I have never seen Silicon Valley so willing to invest in companies that have well-understood financials showing they will probably always lose money. Low-margin businesses have never been more fashionable here than they are right now.

– Sam Altman, President, Y-Combinator and Co-chairman, OpenAI, Unit Economics

There’s been a lot of talk coming out of silicon valley lately about fast growing companies with high valuations that are going to face problems in the coming year(s). But how is this going to happen? The most likely scenario is the thing that has been driving growth (and valuations) for these companies ultimately comes home to roost. And that is negative gross margins. We have seen a tremendous number of high growth companies raising money this year with negative gross margins. Which means they sell something for less than it costs them to make it….Why would [they] take this approach? To build demand for the service, of course. The idea is get users hooked…and then…take the price up…

The thing that is wrong with this strategy is that taking prices up, or using your volume to drive costs down, in order to get to positive gross margins is a lot harder than most people think….

[M]ost of the companies out there who are growing like weeds using a negative gross margin strategy are going to find that the capital markets will ultimately lose patience with this strategy and force them to get to positive gross margins, which will in turn cut into growth and what we will be left with is a ton of flatlined zero gross margin businesses carrying billion dollar plus valuations.

– Fred Wilson, Co-founder, Union Square Ventures, Negative Gross Margins

It’s like the old adage, [when you’re] handing out dollars for 85 cents, you can go [infinitely]…Chosen unicorns are being given hundreds of millions of dollars, but you have to ask how much margin is there. The unit economics would be very difficult, I’d think…It’s like, the last time, all this Postmates and Shyp stuff happened [in] ‘99, with [the failed online delivery startup] Kozmo, [and] it’s the same shit. It’s the same shit…The question for all of those things has to do with core economics that’ll be proven out over time.

– Bill Gurley, General Partner, Benchmark Capital, Interview

Editor’s note: Shyp has since shut down ($50m in funding, valuation of over $250m), and Postmates has been through severe funding struggles.

Don’t Scale an Unprofitable Business

Hopefully the message I’m trying to pass on is clear. If not, perhaps the story of one of the many failed on-demand food delivery startups may help drive the message home. Bento, a startup launched in 2015 that delivered customizable “bento boxes,” raised $2 million in seed capital after an on-stage pitch at one of the more popular startup events in San Francisco. But only a few months after they launched, Bento realized they were burning 30-40% more cash than they had originally anticipated. It was strange, because the company was growing at an incredible rate of 15% per week. After looking at the numbers in greater detail, the answer became clear: Bento was selling their boxes for $12, but it was costing them $32 to make each box. Factoring in the costs of the kitchen staff, the equipment, the ingredients, the drivers, and so on, Bento was losing $20 on every sale.

Running out of cash fast, Bento managed to cobble together $100,000, embark on a rigorous cost cutting exercise which included firing all the kitchen staff and pivoting the business to a catering model. But the new model came with a new set of problems. “It went OK, it grew, but it didn’t grow like crazy,” founder Jason Demant recalled. “I think what ultimately happened is we traded one problem for another, while operationally and from a unit economics standpoint it was better for the business, it was less appealing from a consumer perspective…It still wasn’t enough. While we hit profitability toward the end of the year, margins were thin, we didn’t have a budget to hire a management team or do R&D and really burned through our capital.” Bento eventually shut down in January 2017.

Reflecting on the experience, Demant conceded “I mean, it’s almost a little embarrassing—because I should have been watching [operation costs], especially in an operationally-intensive business like this…What we have learned in the last year basically tells us the way that we started the business was f***ing stupid.”

Don’t scale an unprofitable business. Study your unit economics, make sure you’re contribution margin positive, and keep a close eye on your variable costs.

Further Reading on the Toptal Blog:

- LTV and CAC: What Are They and Why Do They Matter?

- The Statistical Edge: Enhance Your Metrics with the Actuarial Valuation Method

- Aligned for Success: A Guide to What Investors Look for in a Startup

- Industry Analysis and Porter’s 5 Forces: A Deeper Look at Buyer Power

- Price Elasticity 2.0: From Theory to The Real World

Understanding the basics

How do you calculate the economics of one unit?

There are two main ways to calculate unit economics, and the method one chooses depends on how one defines a unit. If a unit is defined as one sale, then contribution margin is the most common metric. If a unit is defined as one customer, then customer lifetime value is the commonly associated metric.

What is the definition of unit cost?

Unit cost is the cost associated with the provision or sale of one unit of a business’ product or service

What is an example of a fixed cost?

Fixed costs are those that do not vary with the output or sales volume of a business. Examples include office costs, salaries of key members of the team, certain technology costs, and the costs of intangible assets such as intellectual property.

What is included in variable costs?

Variable costs are those directly associated with the sale of one unit of a company’s product or service. Common examples include cost of goods (COGS), shipping and packaging costs for eCommerce companies, and sales costs for enterprise/B2B businesses.

Toby Clarence-Smith

Milan, Metropolitan City of Milan, Italy

August 25, 2016

About the author

Toby has deep financial experience across investment banking, VC investing, and PE. He most recently founded and sold a VC-backed company.

Expertise

PREVIOUSLY AT