How to Build Your Startup’s Financial Model to Grab Investor Interest

Hook investors with a financial model that instantly shows them what they need to know about your startup.

Hook investors with a financial model that instantly shows them what they need to know about your startup.

A veteran of VC, Jeffrey now provides investment banking services to early- and mid-stage startups and has served as interim CFO for more than 300 companies and funds.

Expertise

Previous Role

Interim CFOPREVIOUSLY AT

When it comes to financial modeling, presentation matters. A financial model is more than just a spreadsheet full of numbers; it’s a powerful tool that tells the story of your business, outlining its potential and demonstrating its viability. When you’re pitching to investors, your startup’s financial model can help you communicate your company’s value proposition, navigate negotiations, and secure the funding you need to grow.

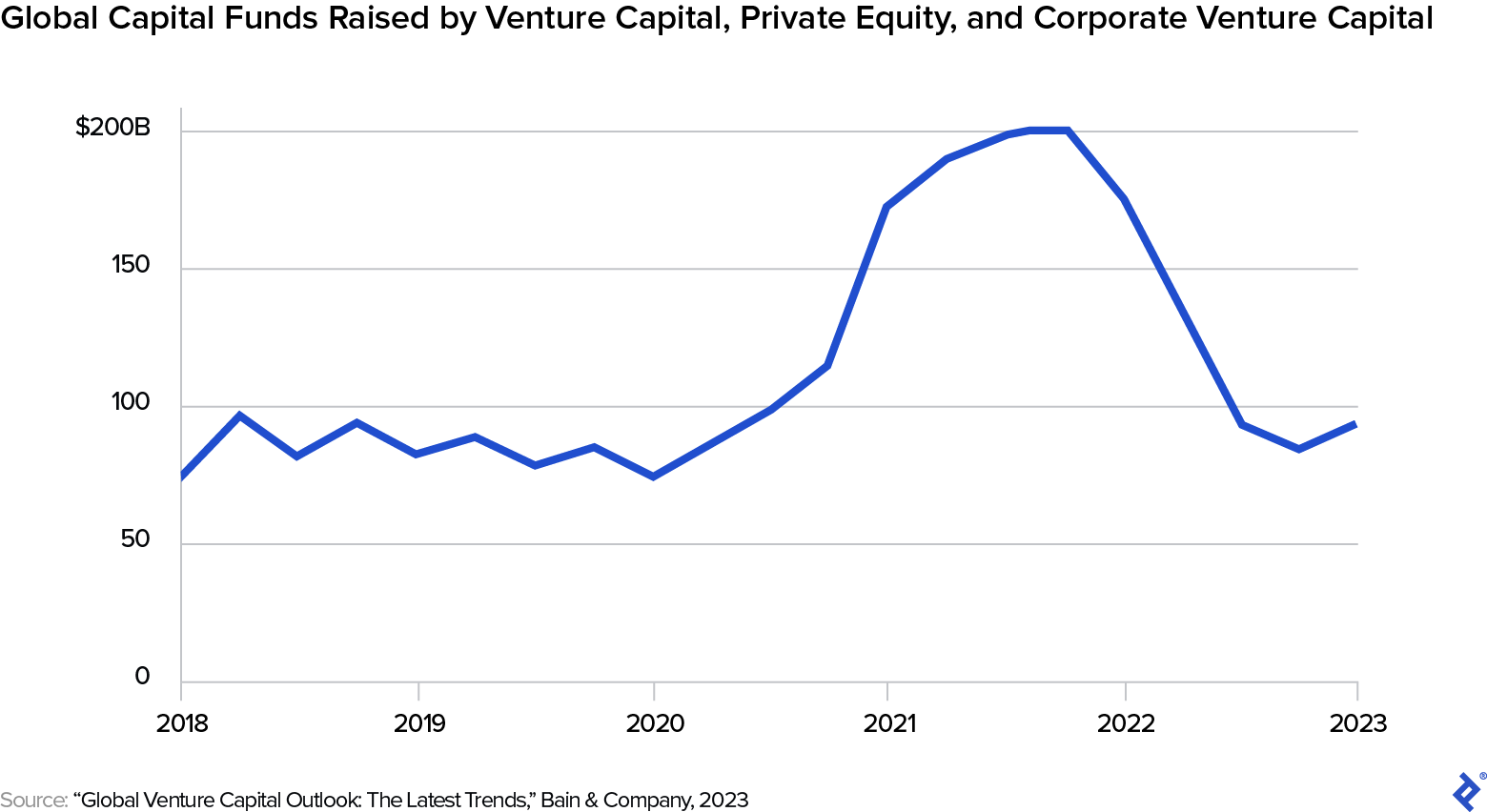

With venture capital now significantly more scarce than it was in 2021, a strong financial model is all the more important. According to Crunchbase, not even the rush to fund AI startups in the second quarter of 2023 was enough to pull global VC out of the doldrums.

As a startup consultant, I aid my clients in M&A advisory, fundraising strategy, pitch presentations, financial modeling, valuation analysis, and more. I have witnessed firsthand the challenges startup founders face when they don’t follow one simple rule: Consider your financial models from an investor’s perspective.

With investors paying such close attention to a company’s financials, you may be tempted—especially if you don’t have a great deal of financial experience yourself—to turn to a professionally designed financial model template for startups. But I don’t recommend this because, in most cases, a template isn’t as plug-and-play as it seems. You could find yourself stuck with large blank areas that don’t apply to your company’s business model, or, even worse, parts of the model that you can’t use because you are unable to tweak the embedded formulas the way you need to. Although it’s additional work on the front end, you’ll get a more useful and professional-looking result if you start from scratch.

In this article, I discuss how I have helped founders build a financial model with investors in mind—and how to use the model to create a persuasive pitch.

Focus on Key Performance Indicators (KPIs)

In your financial modeling, it’s important to strike the right balance between including enough information to provide a comprehensive picture of your startup’s financial health, and not overwhelming investors with excessive detail. Zoom in on the most important metrics, known as key performance indicators (KPIs), which demonstrate your startup’s progress and potential. This can seem obvious at the strategic level, but startup founders often get mired in detail.

I once worked with a startup that had developed an innovative e-commerce platform. It was preparing to pitch to investors for its next funding round, and had built a financial model so overwhelmingly detailed that the primary KPIs were difficult to find. I helped the founders identify and prioritize their startup’s most important KPIs and incorporated them into the financial model. Here’s how to approach getting the balance right:

Understand Your Business and Industry

Start by developing a deep understanding of your business model, your industry, and the factors that drive growth and profitability. This knowledge will help you pinpoint the specific metrics that investors are likely to focus on when evaluating your startup’s potential. For example, a software as a service (SaaS) startup might prioritize metrics like monthly recurring revenue (MRR) and customer acquisition cost (CAC), while a retail business might focus on metrics like average transaction value and inventory turnover. In the case of the e-commerce startup, we determined that metrics for customer acquisition cost, lifetime value, and monthly average users would need to be prominent.

Align KPIs With Strategic Goals

Make sure you highlight the KPIs that most clearly reflect your startup’s overall strategic objectives and growth plan. For example, if your primary goal is to rapidly expand your customer base, you might prioritize KPIs such as the number of new customers, customer acquisition cost, and customer lifetime value. If your goal is to improve operational efficiency, you might focus on KPIs related to cost control, such as gross margin and operating expenses as a percentage of revenue. The aforementioned e-commerce startup I worked with knew how much money it needed to make in sales to break even, but not how that translated to the type and number of customers it needed. We created a dashboard that tracked the number of customers for each sales channel to ensure the startup stayed on target.

Make KPIs Clear and Prominent

Ensure that your chosen KPIs are easy for investors to find and understand within your financial model. Consider creating a dedicated KPI dashboard or tab that presents these metrics in a visually appealing and easy-to-read format, using charts, graphs, and tables where appropriate. You can also include KPIs within your financial statements or in a separate analysis section. Wherever they are, always be certain that they’re clearly labeled and easy to interpret.

I helped the e-commerce startup create a dedicated dashboard that highlighted its key metrics, making it much easier for the investors to see the startup’s performance and potential at a glance. In the end, the company was able to secure its desired funding. The investors specifically mentioned how the clear presentation of KPIs helped them understand the business better and gave them the confidence to invest.

Integrate Your Cap Table

An equally essential step to demonstrate a comprehensive understanding of your startup’s financial and ownership structures is to incorporate the capitalization (or “cap”) table into your financial model presentation. The cap table serves as a snapshot of your startup’s ownership, detailing the following components:

- Founder equity: Ownership percentages held by each founder, reflecting their roles and contributions to the startup

- Investor equity: Shares owned by angel investors, venture capitalists, and other financial backers, along with their respective investment rounds

- Employee equity: Stock options and grants allocated to employees as part of their compensation packages

- Convertible securities: Convertible notes or SAFE agreements, specifying the conversion terms and potential dilution effects

- Dilution scenarios: Potential outcomes of future fundraising rounds, demonstrating your startup’s potential growth and the impact on current stakeholders

Ensuring consistency between your financial model and the cap table provides investors with a cohesive and accurate picture.

Create a Sense of Urgency

A robust financial model can help you emphasize any opportunities and market trends that present unique windows for your startup’s growth—if investors act fast. You can demonstrate urgency by highlighting a number of important factors:

- Time-sensitive opportunities: I once worked with an innovative company that developed a groundbreaking AI healthcare solution. It used its financial model to highlight the potential for substantial revenue from a new government initiative in telehealth with a limited application window.

- Consequences of inaction: A tech firm has developed a new IoT device for smart homes that is unique, but there are competitors on the horizon. Investors would be able to tell from the financial model that delays in funding could rapidly compromise the company’s projected market share.

- Speed to market: A food tech venture with a lean business model and established partnerships might use its financial model to show how quickly it could generate revenue after receiving funding.

- Early-mover advantage: A fintech startup that is first in its niche could leverage its financial model to show the potential for increased market share and brand recognition with investor support.

- Scalability and growth potential: A SaaS firm with an impressive growth strategy might use its financial model to highlight its scalable business model, demonstrating how monthly recurring revenue could skyrocket with increased investment.

Highlighting time-sensitive opportunities can help persuade investors that acting fast is essential for a stronger market position and higher returns—especially useful today, when capital is much less available than it was a few years ago, and investors are increasingly cautious.

Format Your Financial Model for Clarity and Impact

Now that you know what you need to include, it’s time to sit down and build your model. Thoroughness is important, of course, but don’t underestimate the power of smart design too. A good financial model should be as easy to navigate as a well-organized filing cabinet. Here’s how to do it:

- Separate each major component of your financial data into its own tab. The must-have tabs usually include assumptions, income statements, balance sheets, and cash flow statements. There may also be tabs for scenario planning and your cap table.

- Avoid clutter: You don’t need a separate tab for every view or analysis. Use a single tab for each statement or topic, and simply tweak variables to toggle between relevant views.

- Differentiate your content: Use prominent headings and subheadings to divide sections. Use bold text for headings, different font colors for assumptions, inputs, and outputs, and italics for comments or notes. If you need to, use lines and background colors to further differentiate tables, dashboards, and other chunks of information.

- Be consistent: Apply consistent formatting and styling throughout. That means all headers should look the same, all subheads should look the same, all inputs should look the same, all outputs should look the same, etc. This will go a long way toward making your model’s hierarchies and equivalencies easier to understand.

- Develop visual aids to present your model: Create clear and concise charts, graphs, or tables that represent key aspects of your financial model. These data visualizations can help investors quickly grasp the most important information and make your presentation more engaging.

Presentation may seem like a superficial aspect of your model, compared to your actual idea, but I can’t overemphasize how much impact it can have. Let’s consider a real-life example, a SaaS company that I once helped. Its product was great—a financial management and payments tool targeted at SMBs— and its pitch deck was impressive. Its financial model, however, was like a kitchen where you couldn’t tell the ingredients from the cooked food; the investors told the founders that their model made it impossible for them to see the company’s financial potential.

I saw that the company needed someone to step in and help clean up its “kitchen.” I applied consistent formatting to differentiate between the inputs and the outputs, and to make each tab easier to navigate. Immediately, it was much easier for the founders to manage their own numbers and for the investors to understand the company’s potential. As a result, the SaaS startup secured the funding it needed.

Test Your Financial Model—and Never Stop Testing It

A robust, well-tested financial model demonstrates your understanding of the business and increases your credibility. To ensure your model is accurate, reliable, and effectively communicates your startup’s potential, consider this advice:

- Double-check assumptions, inputs, and calculations: Make sure all the assumptions and inputs in your financial model are based on solid data and market research. Check that your calculations are accurate and logically derived from your inputs. Use industry benchmarks or historical data to validate your assumptions and provide a foundation for your projections.

- Stress-test your model: Conduct sensitivity analyses by changing key variables and assumptions in your model to see how the outcomes are affected. This helps you understand the potential risks and uncertainties associated with your business, and prepares you to address investor concerns or questions about different scenarios.

- Seek feedback from trusted experts: Share your financial model with experienced professionals, such as advisors, mentors, or peers who have successfully navigated the fundraising process. They can help you identify any weaknesses, inconsistencies, or areas for improvement.

- Revisit and update your model regularly: As your business evolves, so should your financial model. Regularly update your model with new data, market research, and any changes in your business strategy. This not only ensures that your model remains accurate but also demonstrates your ongoing commitment to understanding and managing your startup’s financial health.

Be Prepared to Answer Questions and Defend Your Assumptions

In my experience, investors—especially for early-stage companies—prioritize two things: whether the numbers are reasonable, and whether the founder actually understands how their business works. To effectively address inquiries and instill confidence, you must know every aspect of your model inside and out so you can explain and defend your assumptions, calculations, and financial projections in detail. Here’s how to prepare:

- Understand your assumptions: It may seem obvious, but you’ll need to be able to explain to investors where your assumptions come from—for example, industry research may reveal trends or cycles you can expect to replicate.

- Explain your methodology: How exactly did you arrive at your numbers? Transparency and willingness to share your process reassures investors and builds credibility.

- Do your research: Your investors likely know more about your industry than you do. Use reputable sources relevant to your field to show that your assumptions are based on information your investors can and do trust.

- Anticipate common questions: Prepare for likely inquiries about your model and practice your responses. For example, if you have a SaaS company, you should be ready to answer questions about how you manage your churn rate, how you plan to scale customer support, and other relevant questions.

Time and time again, I’ve seen how much a simple model refresh can change the game for a startup struggling to break through to investors. A well-formatted financial model ensures that investors can quickly grasp key insights and see the potential in your startup. A poorly formatted model, on the other hand, can create confusion, which undermines the story you’re trying to tell.

Just as important, a model that is well-organized and customized to your business makes it easier for you, as the founder, to read and use. A financial model is the foundation upon which you will build your company. It’s what you will use to make virtually every decision that affects your company’s future: tracking your progress, testing your ideas, allocating resources, seeking funding, analyzing risk, and projecting your growth. Imagine how damaging it would be to make a decision based on unclear, inaccurate, or incomplete information, simply because your model was too confusing.

Not every founder is a nuts-and-bolts finance expert—and you don’t have to be. With expert design and routine tending, your startup’s financial model can make it easier to run your company and increase your chances of securing the investment you need to grow your business and achieve lasting success.

Further Reading on the Toptal Blog:

Understanding the basics

Why is financial modeling important for startups?

A financial model serves two vital purposes for a startup: It provides leaders with a roadmap for the company’s growth, and it serves as the basis for valuing the business.

What is the basic financial model for a startup?

Most startups will be well served by a traditional three-statement model, which combines the balance sheet, income statement (or profit and loss statement), and cash flow statement. A startup should also maintain a capitalization table (cap table) tracking the distribution of equity.

What is a three-statement model for a startup?

A three-statement model is a type of financial model that combines a company’s balance sheet, income statement (or profit and loss statement), and cash flow statement. Together, these provide a complete picture of a company’s past, present, and projected future performance.

New York, NY, United States

September 29, 2016

About the author

A veteran of VC, Jeffrey now provides investment banking services to early- and mid-stage startups and has served as interim CFO for more than 300 companies and funds.

Expertise

Previous Role

Interim CFOPREVIOUSLY AT