State of the Fintech Industry (with Infographic)

Tech firms have enjoyed a deluge of funding in the last few years. Fintech is no exception. Now is the time to see which companies are here to stay and can become profitable - there will be some necessary consolidation and perhaps some high-profile failures.

Tech firms have enjoyed a deluge of funding in the last few years. Fintech is no exception. Now is the time to see which companies are here to stay and can become profitable - there will be some necessary consolidation and perhaps some high-profile failures.

Natasha transitioned to venture capital after a career in banking built in prestigious firms such as JPMorgan and ESM.

PREVIOUSLY AT

Tech firms have enjoyed a deluge of funding in the last few years. As discussed in our State of Venture Capital report, 2018, in particular, was a bumper year, with a total of $254 billion invested globally into ~18,000 startups through venture capital funds—a sharp increase of 46% from 2017’s total. Figures for 2019 are not yet completely finalized, but initial reports point to a slowdown in funding levels in the first half of the year and a mild rebound in Q3. This is true across sectors, and is most definitely true for the fintech sector, which is the largest sector in the growth company space. In fact, the global fintech market was worth $127.66 billion in 2018, with a predicted annual growth rate of ~25% until 2022, to $309.98 billion.

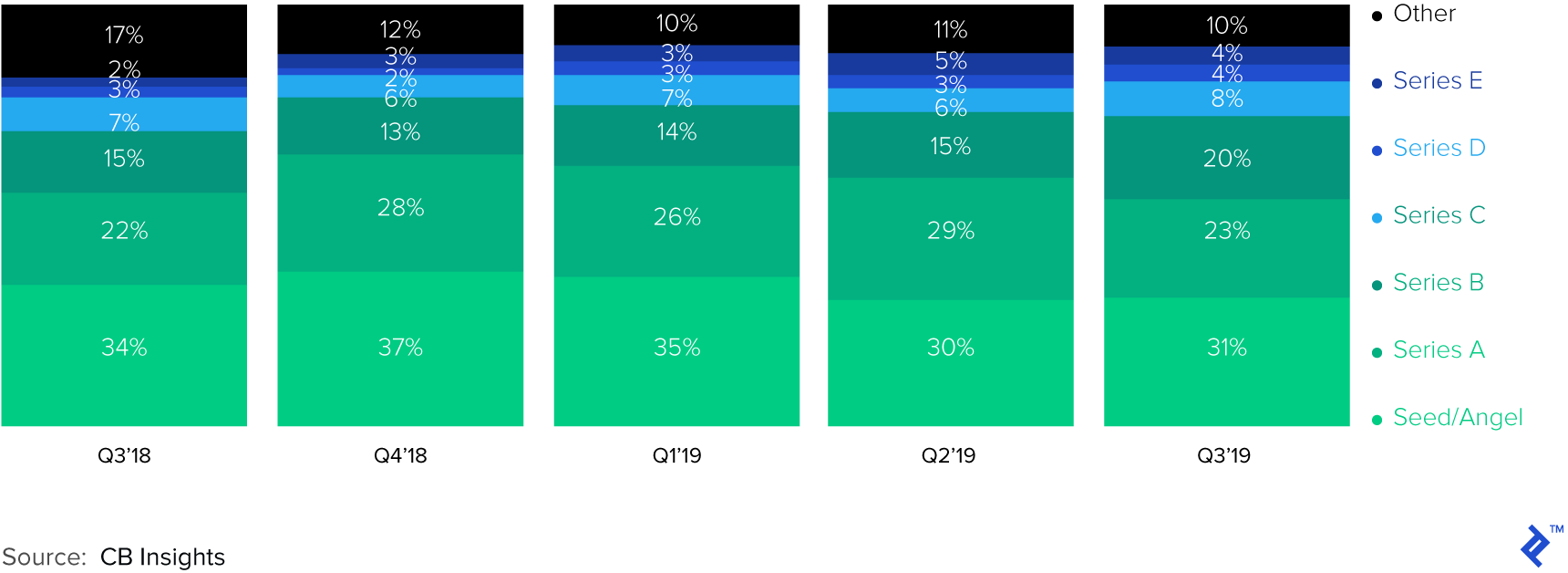

As within the broader VC sector, there is a general trend in the fintech industry toward maturity: larger funds (getting closer in both size and behavior to their private equity counterparts) investing in later stages of a company’s life, as illustrated in the funding statistics section. This, coupled with the retreat in funding for seed-stage companies, points toward a general consolidation and development of the sector.

As the market and the fintech landscape are maturing, now is the time to see which companies are here to stay and can become profitable - there will be some necessary consolidation and perhaps some high-profile failures.

Three factors are contributing to the maturing of the fintech sector:

- The new technologies that helped fuel innovation in this arena (e.g., artificial intelligence and cyber defenses) are also maturing.

- A lot of funds that invested in the first generation of companies that tried to capitalize and build on top of the destruction caused by the financial crash in 2008 are reaching the end of their life, and are thus getting their houses in order to return money to their investors.

- The macroeconomic situation, particularly in the UK (one of the most advanced fintech markets) and in Europe, has deteriorated, slowing down funding to younger and newer companies.

Finally, in terms of geography, more and more mega-deals are happening in developing countries, where a large un- and underbanked population provided a very fertile ground for rapid growth. The mega valuation of Ant Financial (~$150 billion as of June 2019) is a great example of all of these different trends, and we will thus briefly cover it. It is also an interesting case study of how to build a great financial services firm.

Categorization: What Falls Under Fintech?

We define fintech technology as any technology that helps companies in financial services to operate or deliver their products and services, or that helps companies or individuals to manage their financial affairs. Under this definition, we include regulatory technology but not cryptocurrency strictly in the sector (the latter is in order to avoid excessive volatility). Some other reports may use a different breakdown and thus show slightly different total figures.

The main players in the arena of financial services are (listed by magnitude and importance):

- Government entities, which can range widely from regulators, central banks, sovereign wealth funds, and all the authorities that grant licenses and can actively influence the financial sector.

- Traditional financial services firms, which are getting involved both as investors, potential strategic acquirers, and as promoters of innovation. For instance, Citibank, the US bulge-bracket bank, is incredibly and increasingly involved in the sector. It has a range of initiatives such as an accelerator, outside acquisitions, and a venture capital investment team that invests the bank’s own funds (on its own balance sheet no less).

- Tech companies that provide financial services alongside their core products. For instance, both Uber and Amazon have dedicated internal teams of engineers and experts making a strong push toward increasing their presence in the sector.

- Companies that provide technology for financial transactions such as Bloomberg, Thomson Reuters, American Express, Visa, etc. are all technology companies that are part of the fintech ecosystem and need to keep up with all changes in the space and with new competitors that may challenge them.

- Professional investors, which can be categorized based on size (small or large fund), stage (seed, late venture, private equity, etc.), and finally for source of funds, such as pension funds, strategic investors, family offices, etc.

- New, disruptive companies operating in several different sectors, which we will cover in one of the following sections. Most often, these companies got their start by “unbundling” one of the services provided by an incumbent player.

Banking and finance have always been very linked to governments, and are thus a very hard sector to enter. Fintech startup guru Kathryn Petralia summed up the inextricable relationship between state and bank as such: “While technology and market forces are central to the ongoing disruption, however, they will not be the only or even the main driver of outcomes. Banking is ultimately about money, and money is about public authority – this is why, for centuries, banks have been licensed when they weren’t direct creations of the state.”

As the sector matures, it is collectively shifting away from consumer-focused, P2P (peer-to-peer) propositions toward infrastructure, more capital-intensive businesses, and new technologies. However, full disruption is still a long way off; the fintech sector is only biting at the ankles of the banking giants.

Funding Statistics: Maturing Sector Still Has High Growth

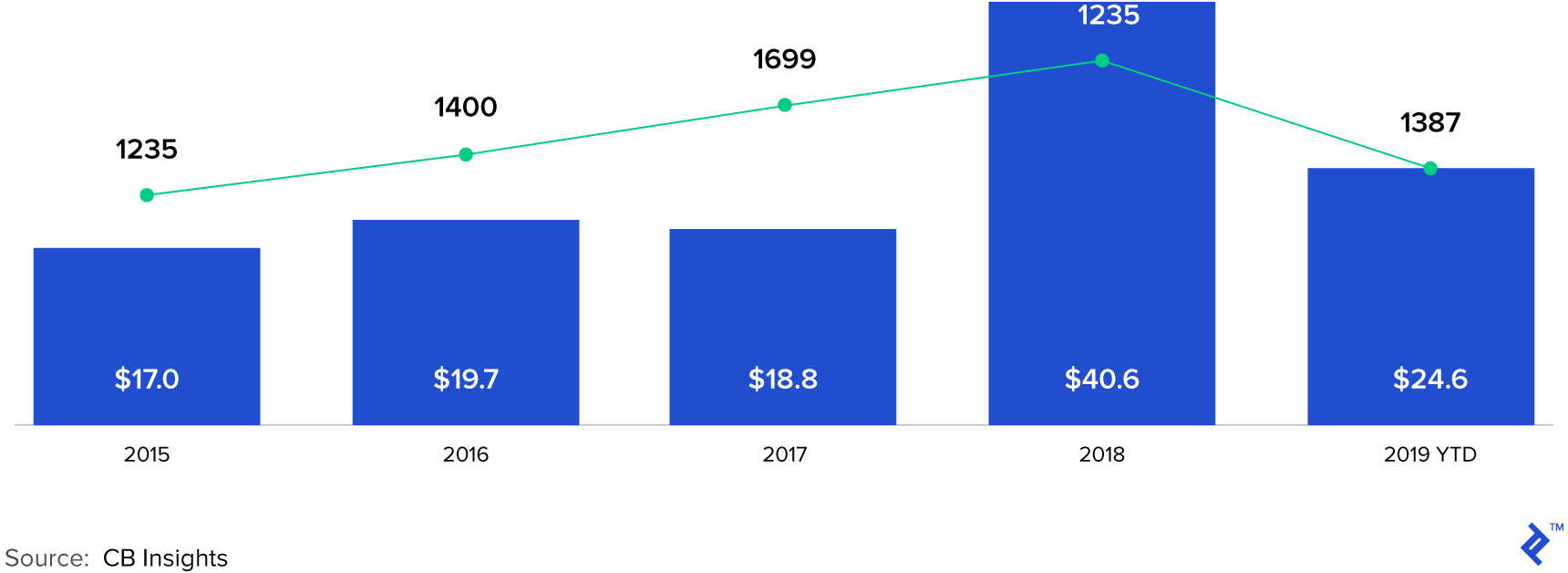

2018 was a record year for fintech (and tech companies in general) - with the amount funded more than doubling compared to the previous year. 2019 has reversed the trend somewhat, with a normalization of volumes but still showing strong historical growth.

Fintech Deals Down from Record 2018 ($ Billions)

Deals are focusing on the later stages: a normal consequence of the stabilization and maturing of the sector.

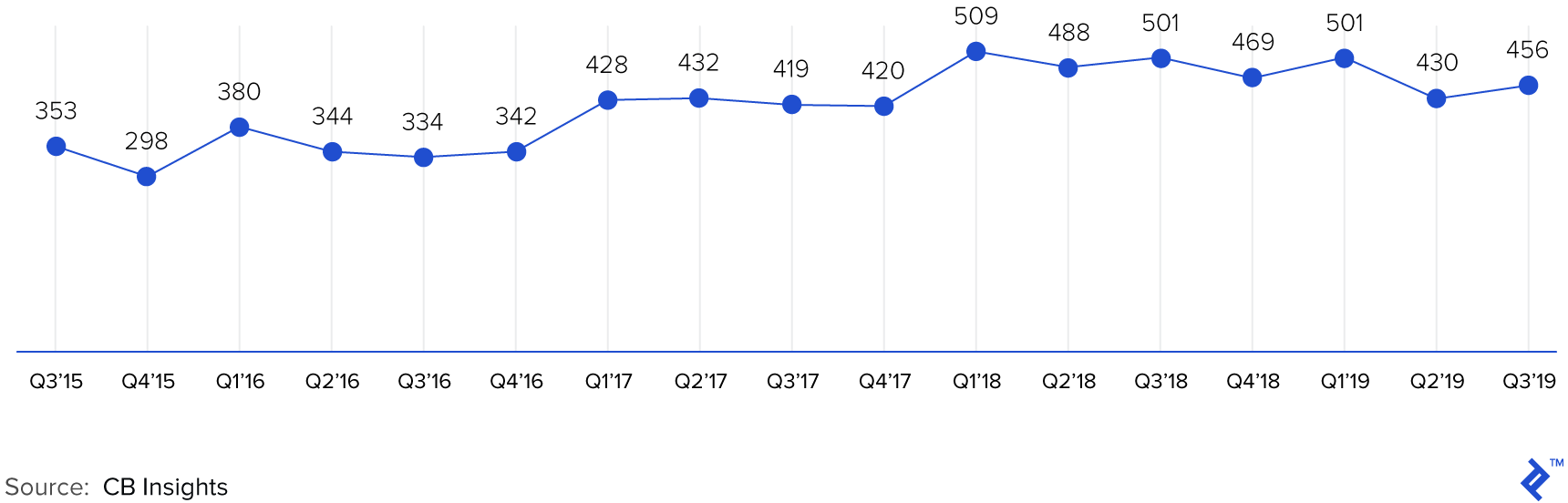

VC Fintech Deals Steadily Up Since 2015

Fintech Deals by Stage and Quarter

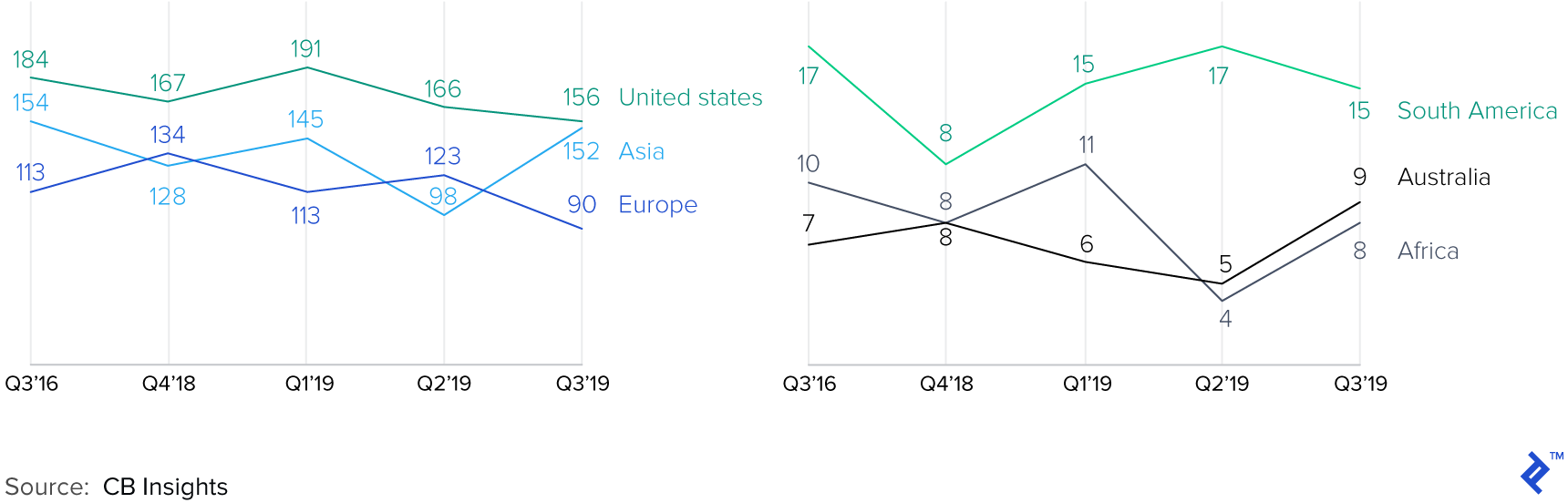

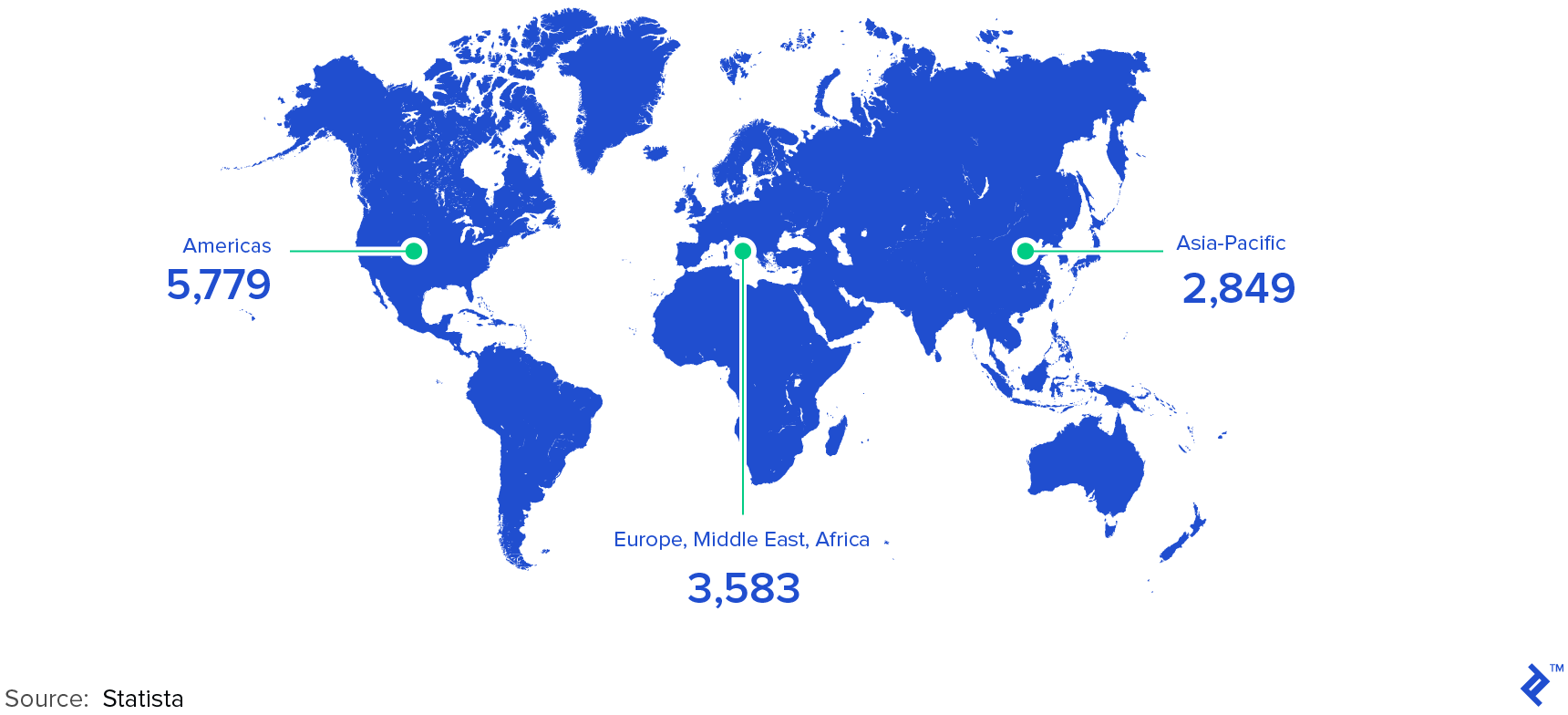

Globally, Asia is becoming a hotbed for fintech investments, partly because of the increased activity and interests of investors like Temasek and GIC, Singapore’s sovereign wealth funds.

Global Deal Distribution by Quarter

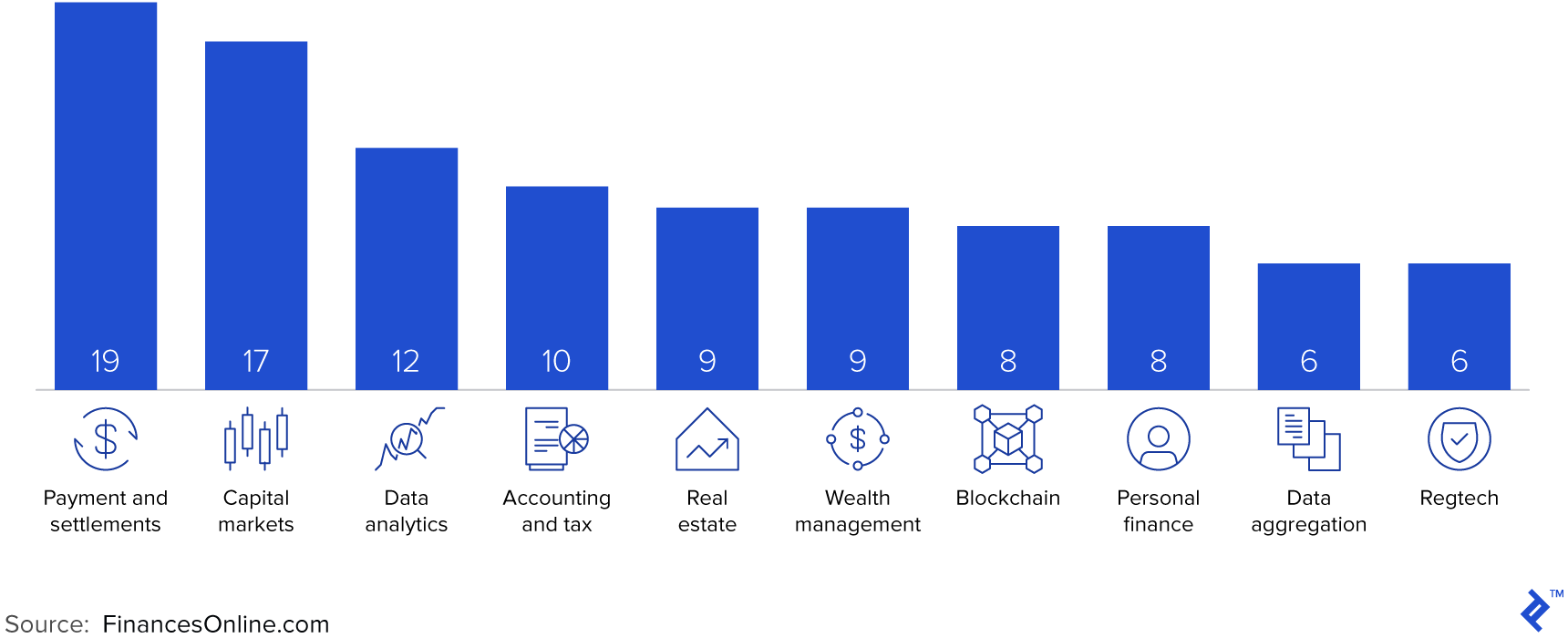

Fintech by Sector, Number of US Bank Investors

North America, however, is and remains the largest market. The continent is home to twice as many fintech companies as the APAC region.

Fintech Startups by Region

Emerging Categories for Companies

In this section, we will cover the taxonomy of emerging categories, adding some insights and examples to each category and some fintech trends.

- Open/challenger banking. The regulatory environment, together with changing customer behaviors, are encouraging financial institutions to embrace the journey toward open banking/challenger banks. Various fintech players in the market are developing platforms that can allow financial institutions to connect to the broader API ecosystem, particularly in the European Union. This is, in part, due to revolutionary new regulation that was introduced in the EU, the Payments Services Directive, PSD2, and in the UK. The UK is a particularly interesting case study. The lowering of capital requirements for approval of a banking license by the FCA (Financial Conduct Authority) created a flurry of new banks being opened and granted licenses after 2011 (while no new bank had been been given one in more than 100 years prior). TrueLayer is a great success story in this arena. The company recently received $35 million in funding from very prestigious investors such as Temasek, the sovereign wealth fund of the Government of Singapore, which is a very prolific and reputable actor in fintech. Temasek is also one of the headline investors in Ant Financial, which is the focus of our little case study.

- Artificial intelligence and machine learning-powered platforms to manage core business processes. These are support tools for operations that are intrinsic to the complexity of financial services and are either paper- or data-intensive. These are instruments that allow users to analyze data, mostly either to provide decision-making support or to detect anomalies. This is the new state-of-the-art approach to fraud detection and compliance to anti-money laundering laws, adopted by companies like FICO and Finastra. A common application is credit scoring.

- Personalized advice platforms, from investment to lending. The focus here is providing improved user experience which is scalable. This can happen because the improvements are powered by simple processes, simple decisions to make on the part of the client, simplified reporting, and all presented with a captivating UX/UI design. This approach is mainly used to address processes like wealth management, life insurance, or loan subscription. These platforms transform a service that, to many users, seems complex and difficult to dominate into something straightforward and almost playful. In addition, they are also used to connect to customers, either to improve user experience through perceived empathy or otherwise to provide data-powered assistance at a lower cost. The range of applications is very large but quite common in wealth and investment management. A good example is Nutmeg, a so-called robo-advisor that provides (simple) automated asset allocation services and advice through machine learning. Nutmeg recently received a cornerstone investment from Goldman Sachs, which has also partnered with it to start delivering their wealth services to retail clients.

- Insurance and pension. Much like challenger banks and investment product startups, new companies in the insurance and pension space are digitally native and aim to simplify a complex process while offering transparent UX and tools to facilitate investment management. PensionBee created a lot of buzz in the London fintech investment community when they were able to raise sizeable capital in 2017 (the amount was never confirmed, though). The segment, however, presents many difficulties for a new company—it is heavily regulated and requires high capital buffers and complex actuarial systems. It is also difficult to scale as regulation and pension systems vary greatly from country to country.

- Lending and crowdfunding platforms. The new generation of lending and crowdfunding platforms are marketplaces that help the two sides of the transaction (funder and funded, or creditor and debtor) by standardizing the process and helping with marketing and legal materials. They are mostly utilizing enhanced processes powered by data analytics, offering seamless process steps between subscription, data collection, and analysis. Many players that are developing lending platforms aim to simplify the process and reduce lending time (from loan application to disbursement). LendingClub is by far the best-known company with this business model in the debt space. Other companies, like Avant, are more like traditional lenders and are expanding in the credit card space. An important caveat for companies of this type is that they are constrained in their borrowing (or equity) power by their own ability to fund. Not only that, but a failed crowdfunding round (particularly for equity) can be extremely damaging to a fledgling company.

- Security and identity. Another interesting application of technology is security. Companies offer products that aid in the process of client onboarding, including companies that are developing solutions related to digital/cyber identity, biometric authentication, and fraud detection. Temenos is a leader in the sector.

- Mortgage and real estate. Companies like Rocket Mortgage have unbundled a different part of the traditional lending business of banks. They have greatly benefited from the reputational damage that the mortgage business mistakes and collapse brought before the last decade, as well as from the change in consumer behavior and interactions with their financial service providers.

- Blockchain. Applications of this technology usually have been studied and applied in cases that revolve around contracts, but there are also interesting features regarding identity management and onboarding processes. No real standout player has emerged from this space.

- Payment technologies. Ranging from cryptocurrencies to global account management and FX management, fintech in the payments industry offers a broad range of innovative solutions. TransferWise is the European unicorn that was recently valued at $3.5 billion after the founders sold a stake.

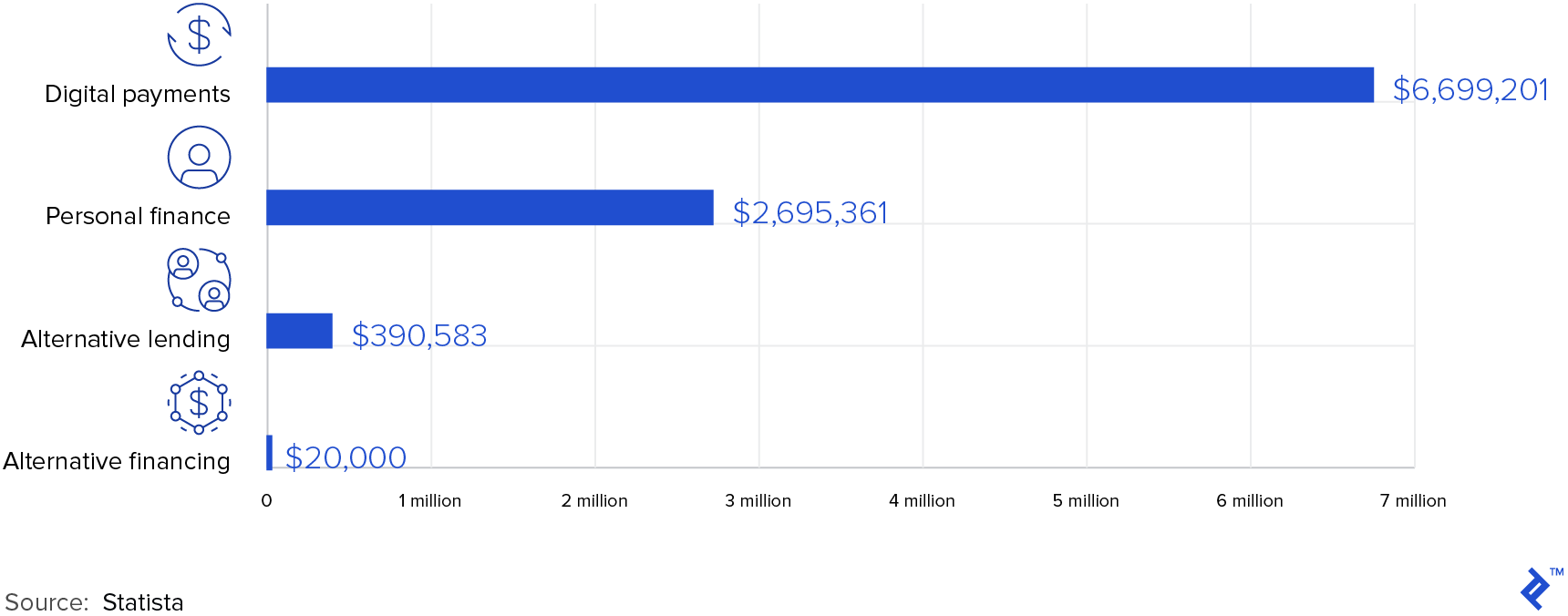

Relative Size of Fintech Segments

Drivers and Trends

Among the many new companies that operate in the financial services technology space, a few clear categories have emerged that are in direct competition with banks and other more “traditional” financial services companies. Traditionally, the market entry point (and thus the go-to market strategy) for many of these companies has been unbundling banking relationships and services, particularly in the case of the ones focused on consumers, as opposed to those with a B2B business model. What does this mean in practice?

Financial services, as an industry, has traditionally had extremely high barriers to entry. This is because of a combination of factors, such as the high regulatory burden on them (which also changes by country because of the influence and style of the regulatory bodies), high capital requirements that can make it prohibitive to start a new enterprise (especially for retail banking and insurance), and because of risk management and compliance needs, which require a set of tools that are costly and complex. This has allowed traditional banks (from retail to corporate) to cross-sell to their clients heavily, which, in turn, increased the stickiness of the business. This practice had, at times, a negative impact on customer service levels and pricing power, as it became quite difficult for a client with a complex set of products and long-standing relationships to disentangle itself and change provider.

The real game-changer for the stagnating financial services sector was the coincidence in timing of a large-scale financial crash and a surge of technological advancements. Suddenly, the entire industry started suffering from a poor reputation, which prompted many to seek alternatives, while most institutions were focused internally to adhere to the new and increased requirements that came from the lessons learned by regulators and lawmakers in the crash. At the same time, technology advanced sharply.

Think how disruptive a company is when it can service a disgruntled banking customer who now also has a smartphone that can support a native app. These companies started identifying a part of the value chain that offered poor user experience and innovated upon it with technology and product. Digital-only banks, such as Monzo, Nubank, and Azlo, are examples of this. Monzo, for instance, initially known as Mondo, advertised itself as an innovative bank that could improve the overall experience of customers and “close the digital gap.”

Sector Evolution: With Maturity Comes Rebundling

As the sector evolves, and startups (or rather scaleups in this case) become more sophisticated and begin having access to larger amounts of capital, they are also starting a process of rebundling banking products and services.

For example, Zopa, the British P2P lending company that was one of the pioneers in the sector (founded in 2005), decided to become a bank in a process that has not been without its difficulties. Revolut, the controversial fintech unicorn that is leading a strong global expansion, has also taken similar steps, while also adding crypto services to its product range; however, Revolut has not yet been able to achieve profitability. Finally, a great example of multiple trends realizing in one company is Figure, the latest unicorn started by the founder of SoFi. The company provides home equity release while utilizing blockchain technology.

In general, the focus of younger companies appears to be moving from B2C to B2B as the former market becomes extremely crowded with several copycat ideas and some companies struggling because of the challenging macro and business environments, with a lot of interesting companies finding traction in the following segments:

- Capital markets infrastructure, helping capital market players secure and innovate on their technology systems (pricing, settlement, KYC, etc.).

- Compliance and regtech tools still developing as regulatory burden keep increasing - this can range from fraud prevention to AML to KYC.

Large institutional players (including banks, large investment funds, and tech companies) are increasing their allocation and attention to the sector, getting more and more involved, both through investing and building products.

Segmentation by Customer

| Customer | Trends |

| Consumer | Lending Personal finance Money transfer / FX / Remittances Payments and billing Crypto Insurance |

| High Net Worth (HNW) | Wealth management Crowdfunding and other investment platforms Real estate |

| B2B - small-to-medium enterprise (SME) | Infrastructure providers Lending Insurance Payroll and accounting |

| B2B - enterprise | Capital markets Regtech Infrastructure providers Blockchain Insurance |

Trends to Watch

Consumer

The consumer market is perhaps the most saturated, and also the easiest to conquer. Consumers, however, tend to have low loyalty, and be sensitive to design and experience initially, but then be swayed by price and convenience.

- Companies targeting consumers with a few clear themes. There is a wealth of personal finance apps built on banking APIs and of a differing level of sophistication.

- Many new types of insurers are emerging, focusing on different types of end-user insurance (car, bicycle, etc.). This is the least capital-intensive type of insurance and the easiest to get off the ground - it is still very early to see a real disruption along insurance lines.

- Quite a few companies are targeting the self-employed and freelancers, offering services to the ever-increasing number of people that work in alternative ways.

- The lending space is very crowded, in the same manner as in the B2B space, creating a ripe environment for acquisitions and consolidation.

- The wealth management and investment space is most differentiated and interesting - AI technology advancement makes it now possible to offer services such as frequent investment portfolio rebalancing, which were previously only available to sophisticated private investors or high net worth individuals.

High Net Worth Individuals

HNW individuals are a separate class of consumers: They are more sophisticated and have more complex financial needs. The offering that is specifically targeted to them focuses around innovative and automated investment opportunities.

- Many wealth management and personalized advice platforms target HNWs. They are meant to streamline the private banking process, facilitating access to innovative asset classes (such as startups, for instance) and reducing portfolio rebalancing costs.

- Another offering geared toward this clientele focuses on real estate and loan direct investing. HNWs are targeted as the supply-side of P2P or digital loan marketplaces, both for personal or SME loans, as well as direct investments in real estate projects.

B2B - Enterprise

Enterprise clients are notoriously challenging. Sales cycles are much longer, the customers can be more demanding, require a lot of bespoke features, and they often expect a degree of professional services to be provided together with tech products. However, they are also very lucrative and can provide income over several years if they find a solution to a real business problem.

- Startups targeting enterprises are much more differentiated - they tend to focus on business services and core business processes. This is an area of great focus, particularly for large banks, which are still adjusting to the changes in regulations that have come as a result of the financial crisis. Any company that offers a tool that can help not only streamline the process but also to reduce costs (some banks spend up to 20% of their total costs on compliance - the amounts at play are staggering).

- Wealth management and capital markets are the predominant target segments for investors, particularly in seed stage. As the consumer segment matures, more complex products targeting more sophisticated clients are emerging. These companies have enjoyed higher amounts of funding even at earlier stages, following the general VC trend for larger deals.

- AI applications and infrastructure are the most interesting areas for investment and more differentiated offering - the evolution of AI technology creates a fertile ground for new ideas.

B2B - Small-to-medium Enterprise

Small and medium enterprises offer great opportunities for the fintech entrepreneurial community. SMEs struggle with the increased complexity imposed on them by changing technologies and do not often have the resources to build inhouse tools.

- A great example of this are tools that facilitate accounting and invoice automation, such as Basware.

- Benefits and business banking services are also becoming more popular.

- The lending space is very crowded, in a similar vein as the lending space for consumers - the most established players will survive but a consolidation is to be expected.

- Pension services are most interesting but not easily scalable as capital-intensive and dependent on regulation - these companies directly compete with traditional pension providers.

Ant Financial: Addressing Customer Needs + Big Backer = Winner

Ant Financial is, as of the summer of 2019, the most valuable unicorn in the world, after it had a reported valuation of around $150 billion. To put that in perspective, it makes Ant Financial approximately as valuable as Goldman Sachs ($79.46 billion) and Morgan Stanley ($79.05 billion) combined. It also makes Ant Financial one of the most valuable tech companies in China, a country with a population of close to 1.4 billion people. But what makes Ant Financial so interesting and such a good example of what the current state of fintech is? It is the fact that it is following the trajectory and trends we have identified at record speed - the company is shifting from being a pure payment business toward being more of a full-range financial services company.

Ant Financial was previously known as Alipay, the payment tool for Alibaba. It was originally developed to help facilitate transactions on Taobao, the Chinese competitor to eBay. By creating trust among users, it enabled the explosive growth of the Alibaba group, led by Jack Ma. Alipay was then spun off from Alibaba and started offering a broader range of financial services. Alipay was effectively responsible, together with the Commercial Bank of China, for building the basic electronic payments network in the country. Previously, all payments were handled with paper transactions and had to pass through the People’s Bank of China.

Moreover, China saw a boom in technology adoption by its population. They were also becoming wealthier, and thus in need of increasingly complex (and higher margin) financial products.

This perfect storm made Ant Financial into a powerhouse. It currently has 1.2 billion customers worldwide (¾ of whom are in China) and aims to grow to 2 billion over the next decade. Currently, it is estimated that around 60-70% of the company’s revenues come from payments, but this percentage will steadily decline as the Ant keeps strengthening their customer proposition and offering higher-value products like mortgages, credit cards, and credit scoring. This will effectively make them a modern, full-service bank, the bank of the future. For reference, a traditional retail bank will have around 30% of their revenues from payments.

Conclusion

The radical transformation of the financial services industry through fintech disruption is still underway. The regulatory tightening that started with the financial crash of 2008 is continuing at a strong pace, and thus forcing traditional players to embrace innovation. The market is maturing, with fewer but larger and later-stage deals taking place. The consumer and lender segments will face a strong consolidation, particularly if the macroeconomic situation deteriorates sharply.

It is worth noting that most of the underlying “plumbing” (i.e., the nuts and bolts that underpin financial transactions) is still almost entirely provided by traditional banks. This is because the requirements are prohibitive for any startup. For example, for any loan to an SME, a bank is required to hold 85% of the loan amount in regulatory capital. It will be challenging for fintech players to completely disentangle themselves from banks and at the same time receive the blessing of regulators. Zopa’s latest troubles are a good example - the company had to do a last-minute fundraise in order to fulfill a capital injection request from the FCA. Failing to do so would have meant losing its preliminary banking license.

Ultimately, vying for private equity capital or going public will put many of the largest companies in the space to the test. Can they finally deliver on investors’ expectations and become profitable? Are they able to pass muster with the competent authorities and gain significant market share in developed countries? How many fintechs will survive? What will the fintech landscape look like? Who will get acquired by a strategic investor? But finally, the parting question is: Is it possible to build a profitable bank of the future in the West, like Jack Ma has achieved in China? If you need a strategic partner to support you in the fintech crusade, Toptal has a team of fintech developers, designers, and business experts in place to assist.

Further Reading on the Toptal Blog:

Understanding the basics

What does fintech stand for?

Fintech stands for “financial technology” - any technology that helps companies in financial services to operate or deliver their products and services, or that helps companies or individuals to manage their financial affairs. We include regulatory technology but not cryptocurrency in the sector.

How big is the fintech industry?

The global fintech market was worth $127.66 billion in 2018, with a predicted annual growth rate of ~25% until 2022, to $309.98 billion. It is still very small compared to the global financial services market.

What is considered fintech?

Many innovative companies that operate in financial services, such as P2P lenders, payment technologies companies, alternative (or robo) investment platforms, digital or challenger banks, etc. The sector is very broad.

About the author

Natasha transitioned to venture capital after a career in banking built in prestigious firms such as JPMorgan and ESM.

PREVIOUSLY AT